North Sea Brent crude plays a critical rolet in setting world oil prices. Here in the US, most folks pay more attention to West Texas Intermediate (WTI) - the North American equivalent benchmark. We regard Brent as just a figurehead for the international market and rarely look beyond the Brent/WTI spread. Yet Brent crude assessments based on physical trades or the ICE Brent futures market are used directly or indirectly to price 70 percent of world oil. Today we begin a “deep dive” series explaining how the Brent crude market operates.

Regular RBN Energy readers will be aware by now that crude oil market watchers spend an inordinate amount of time poring over the tea leaves to discern the nuances behind the price differential (spread) between Brent and WTI (see Brent WTI Reconciliation Dreams Shattered). In our mission to shed light on the way energy markets work RBN Energy has already provided explanations of how the WTI physical crude market operates and how pricing is linked to the CME WTI NYMEX futures contract (see The Cost of Crude at Cushing – WTI and the NYMEX CMA). With this blog series we turn our focus to the Brent market.

For those new to the crude markets and not yet trained in the jargon that pervades the murky world of oil trading we warn you to tread softly through the explanations that follow. Things get complicated as soon as you try and define Brent crude. You would think that was simple – but you would be wrong. There is a crude called Brent and it is produced in the North Sea – that’s a fact. However the Brent that crude traders talk about – the one that is used as a benchmark for international pricing and that underlies the ICE Brent futures contract – is actually more than just Brent crude. As it turns out – what folks call “Brent” is made up of crude oil produced in dozens of different North Sea fields and delivered to market in four different streams at four different locations.

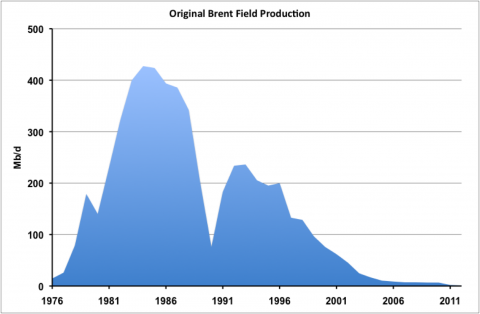

The reason for the Brent market using a blend of different streams is that supplies of genuine Brent started to run out as soon as trading the crude got popular. Brent crude production started up in the late 1970’s (see chart below) and peaked in the mid-80’s at around 400 Mb/d before declining to a trickle during 2012. As a result trading in genuine Brent (that was by 1988 the reference crude for the ICE Brent futures contract) was almost immediately constrained by limited supplies.

Source: UK Petroleum Production Reporting System (Click to Enlarge)

What happened next (1990) was that the powers that be – consisting of Brent and other North Sea crude producers and price reporting agencies – cooked up a new crude called “Brent Blend” that included Ninian and several other crudes produced from separate North Sea fields but gathered through a common pipeline system to the Sullom Voe terminal in the Shetland Islands. Adding Ninian and the other grades created additional volumes to trade – keeping the physical market liquid and active. Over time this problem of declining production kept on recurring and causing further additions to the tally of crudes traded in the Brent market and the locations to which those crudes could be delivered. In 2002, the definition was widened to include production from the North Sea Forties stream - a mixture of oil from separate fields collected by pipeline to a terminal in Hound Point in the UK and the Oseberg stream - a mixture of oil from various Norwegian fields collected to the Sture terminal in Norway. In 2007 still another new stream, Ekofisk, was added to the Brent complex – again to help stem declining production. Ekofisk is gathered and delivered from North Sea fields to a ConocoPhillips terminal at Teesside in the UK.

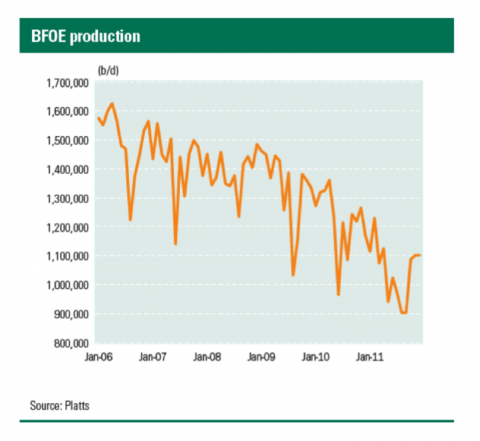

So what started out as one crude morphed into a number of different crude streams that currently produce about 1 MMb/d between them and are known variously to physical traders as the Brent market or BFOE (standing for Brent, Forties, Oseberg and Ekofisk). Even with all these additions of new crude streams production is still declining. The chart below – from our friends at Platts - shows the overall production of the BFOE streams from 2006 up until the end of 2011 fell by about 0.5 MMb/d.

How does trading in the BFOE market work? The terms of trading have changed over time but are governed by something called the SUKO 90 contract. SUKO stands for Shell UK Oil Company - one of the largest BFOE producers. The participants in this market trade in vessel size parcels of 600 MBbl. That is an important distinction to note because it sets the barrier to entry into this exclusive trading club pretty high. Whereas you only need to buy one 1000 Bbl contract to trade ICE Brent futures – costing $100,000 at $100/Bbl - buying a 600 MBbl Brent physical cargo at $100/Bbl will set you back $60 MM and require a banker’s letter of credit upfront. That price tag keeps out the panhandlers.

BFOE producers take physical possession of their crude allocations at one of the four terminals where Brent crude streams are delivered (Sullom Voe, Hound Point, Sture and Teesside) by showing up with a suitable oil tanker during a scheduled 3-day window. The schedule and frequency of the parcels due to any one producer is dependent on monthly production and a producer’s equity in the oil field.

If a producer has their own refinery (e.g. Shell, BP, ExxonMobil etc) they can simply pick up their crude parcels and deliver them direct. For producers that want to sell their crude to third parties there are two distinct trading mechanisms that are used. These two trading mechanisms are linked together but for reasons of timing they are treated as different markets by price reporting agencies. Here is how it works. A BFOE producer will know ahead of time that he is going to receive parcels of crude during particular months based on production volumes. The producer can sell these parcels or cargoes (600 MBbl) ahead of time to refiners or other crude buyers wanting to secure supplies. As the delivery month for a parcel draws near, the terminal will agree with the producer a loading schedule that includes dates for the 3-day windows when they can take delivery of their allocated parcels for next month. These dates typically become known 25 days or more ahead of delivery. If the producer sells his parcel during the period before its date is known then this transaction is considered to be part of the Brent “paper” market because what is being traded is a promise to deliver a cargo during a future month rather than a physical parcel. The “paper” market is also known as a forward market and transactions occur as far as three months ahead of the delivery month.

When a producer sells a parcel that already has a 3-day loading window then that transaction is considered to be part of the “dated” Brent market. That is because the parcel to be sold has a date attached to it and is therefore considered physical or “wet”. Once a buyer has purchased a dated Brent parcel they can arrange for a vessel to pick up their cargo or they can sell it on to another buyer who must likewise make arrangements to pick up the cargo. Importantly when a producer sells a cargo in the paper market (i.e. more than 25 days out) then the SUKO contract covers the precise manner in which the crude oil turns into a dated physical cargo. The contract specifies that the producer/seller must provide the buyer with at least 25 days notice of the 3-day loading window. Once the notice period is expired (i.e. the 3-day loading window is less than 25 days away) then the parcel has become “wet” and if it is traded again it is classified as dated Brent.

Over time transactions conducted in paper and dated Brent markets for BFOE have attained a huge significance as a benchmark in setting the price of crude oil worldwide. Price reporting agencies such as Platts and Argus make daily assessments of transactions in the paper and dated Brent markets and report these prices in their publications. During the period between 1980 and 2010 or so, the majority of crude producers outside of North America used price reporting agency assessments for dated Brent (e.g. Platts Dated Brent) as a major component in their crude pricing formulas. For example, a typical cargo of Nigerian Bonny Light crude might be sold using a formula based on dated Brent prices quoted during the 5 days around the date the cargo was physically delivered (known as the Bill of Lading date or BOL) plus a negotiated differential based on the relative value (quality) of Bonny Light to Brent. In this way assessments for dated Brent ended up in formulas for huge volumes of crude oil worldwide.

The growing market dependence on the dated Brent price gave rise to concerns about manipulation of the paper and dated Brent markets by unscrupulous traders. Those concerns were amplified when the number of Brent cargoes being traded declined because of falling North Sea production. Such market fears were not without basis in the very different trading environment that existed in the 1980’s long before the days of Dodd Frank. There were several attempts to “corner” the Brent physical market by traders buying up all the available cargo parcels for a particular delivery month with the intention of “squeezing” buyers left without crude to make them pay an inflated price. Another common trading game known as “clocking” occurred (for example) in a falling price market where traders played a version of musical chairs by rapidly exchanged ownership of paper Brent contracts right up until the 4:00 PM deadline before the 3-day window notice period expired - leaving one unlucky participant holding a wet cargo that lost value as soon as it became dated because prices were being assessed lower in that market.

Those days are gone now and all traders behave themselves. However market participants are perennially concerned that the lower the number of cargoes traded openly in the BFOE market, the less transparent the price assessments will be and the greater the possibility of manipulation. At a time when 70 percent of the world’s crude was priced using dated Brent, you can understand why dwindling production of the Brent streams was a big concern. Nowadays producers prefer to price crude sold outside North America using a Brent ICE futures related price. For example the Saudi’s use the Brent Weighted Average (BWAVE) that is a volume-weighted average of the day’s trade prices for prompt month Brent ICE futures instead of dated Brent. However as we shall see in the next episode Brent ICE futures prices are still linked directly to the BFOE market and so dated and paper Brent assessments still play a critical role in world oil price setting.

Having done our best to explain the physical Brent trading market and why Brent is really a mixture of crude streams we will call a halt at this point. In the next installment we will explain how the BFOE market is linked to Brent ICE futures through the exchange for physical (EFP) mechanism. Then we will explain recent divergences in the price and quality of the four BFOE crude streams and how they add a new layer of complexity to an already cryptic price mechanism. As is so often the case in the world of crude oil, what seems on paper to be straightforward becomes far more complicated as soon as you have to deal with the myriad qualities of the physical commodity.

|

Each business day RBN Energy releases the Daily Energy Post covering some aspect of energy market dynamics. Receive the morning RBN Energy email by signing up for the RBN Energy Network. |

Crazy Little Thing Called Love was a hit for Queen in 1980