China’s appetite for crude oil has been lower than expected this year, largely due to a slowing economy and the increased adoption of electric vehicles (EVs). And the U.S.’s #1 economic and geopolitical rival is in the midst of another transition that could further weaken crude oil demand: Heavy-duty trucking in China is increasingly being powered by LNG instead of diesel. In today’s RBN blog, we discuss the trend toward LNG-fueled trucking in China and what it could mean for LNG exporters in the U.S.

In the first blog of this series, Trouble, we talked about how significant China’s oil demand has been for global markets for most of this century. However, the Chinese economy has been weakening for various reasons in recent years, including a crisis in its property market, which has caught up with its oil demand. The increased prevalence of EVs and high-speed rail has also put downward pressure on gasoline and jet fuel demand. Now, a slowdown in diesel consumption is at the forefront. Diesel has historically been a primary transportation fuel for trucks, trains, vessels and barges. It also fuels most equipment and vehicles used in construction and farming. Simply put, strong diesel demand has historically correlated with a country’s economic health.

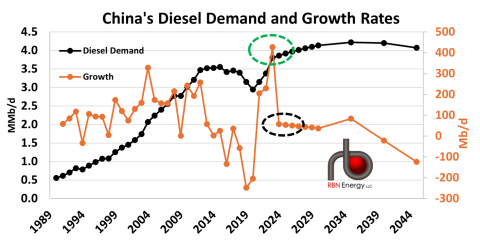

China typically relies on local refineries for most of its diesel supply and is a net exporter. Diesel demand (black line and left axis in Figure 1 below) has recovered fully from the effects of the pandemic and has reached record levels, based on data from RBN’s Refined Fuels Analytics (RFA) practice. But while diesel demand is now approaching 4 MMb/d, annual growth rates (orange line and right axis) have slowed dramatically, the data shows, with 2024’s gain (dashed black oval) estimated at just 57 Mb/d, down from the record 427-Mb/d gain in 2023 (dashed green oval). Annual growth rates are expected to stagnate for the next several years, followed by actual declines in total demand by the early 2040s (right ends of black and orange lines). Why is this happening?

Figure 1. China’s Diesel Demand and Annual Growth Rates. Source: RBN’s Refined Fuels Analytics

Join Backstage Pass to Read Full Article