The International Energy Agency (IEA) and others have lowered growth targets for global oil consumption in the short term, while traders began a sell-off in crude benchmarks before the recent recovery in oil prices. Their main concern? China, which has accounted for a large part of global demand growth, has recently seen a sharp drop in oil demand due in part to an economic slowdown as well as a sharp increase in electric vehicle (EV) adoption. In today’s RBN blog, we will examine what’s happening in China, what it means for global oil demand, and where additional demand growth might come from.

Oil demand from China, the world’s second-largest economy, has been a big deal for the market since the start of this century. China’s determination to grow its economy resulted in periods of rapid, double-digit GDP growth, boosting petroleum demand. In fact, for more than a decade, Chinese oil consumption accounted for more than half of global oil demand growth. China has also established a U.S.-style national oil reserve and buying for it has routinely lifted sentiment in the international oil market.

In recent years, however, agencies like the International Monetary Fund (IMF) have warned of an economic slowdown in China. The weakening economy — including a crisis in the property market after numerous major developers filed for bankruptcy — has caught up with China’s oil consumption, according to the IEA, curbing oil demand growth globally in the short term. The Chinese government has recently announced stimulus measures and cut interest rates in an attempt to boost its economy but there are long-term concerns as well.

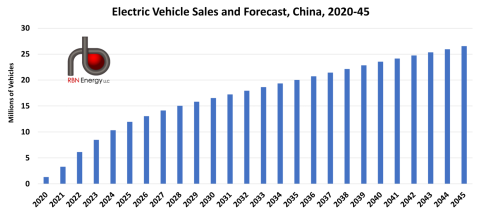

China’s transportation sector is evolving. There’s been a recent surge in EV sales (see blue bars in Figure 1 below) as the government continues its policy incentives to transition to a low-carbon economy and meet climate goals. (China plans to have its carbon dioxide (CO2) emissions peak by 2030 and hit carbon neutrality by 2060.) It helps that China dominates the supply chain for lithium-ion batteries and benefits from its vast manufacturing capacity for EV components, which we discussed in Tell It Like It Is. EVs or plug-in hybrids accounted for 53.5% of new vehicles sold in China in August, according to China Passenger Car Association data, up from about 7% just three years ago, and are expected to continue growing through 2045. By comparison, EVs and hybrids made up 19% of new-car sales in the U.S. in Q2 2024, according to the Energy Information Administration (EIA). The impacts from this are beginning to be felt in the form of slowing gasoline demand growth, and RBN’s Refined Fuels Analytics (RFA) practice expects Chinese gasoline demand to peak either this year or next. (For more on the global refining and overall liquid products sector, see RFA’s latest Future of Fuels report.)

Figure 1. Electric Vehicle Sales and Forecast, China, 2020-45. Source: Refined Fuels Analytics

Note: Sales Figures Include Fully Electric Vehicles and Hybrids

Join Backstage Pass to Read Full Article