PADD 1 — the East Coast — represents about 31% of total U.S. consumption of refined products (and 37% of its population) but is home to just 5% of U.S. refinery capacity. With only minimal in-region crude oil production, PADD 1 refineries are almost entirely dependent on imported and domestic inflows of both crude oil and products like gasoline, diesel and jet fuel. In the early years of the Shale Era, large volumes of domestic crude were railed or barged to these refineries, but in recent years they’ve again become largely reliant on imports from OPEC, Canada and other foreign sources. In today’s RBN blog, we’ll look into PADD 1’s changing crude oil and refined products supply and demand balance.

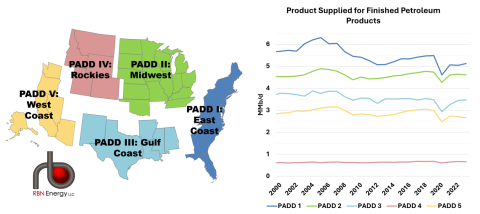

Figure 1. U.S. PADD Map and Product Supplied for Finished Petroleum Products by PADD. Source EIA

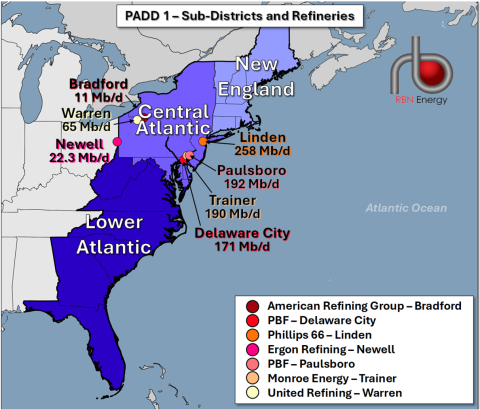

The U.S.’s Atlantic Coast, stretching from picture-perfect coastal towns in Maine to the tropical Florida Keys, is the home of New York City’s iconic skyline, Philadelphia’s historic landmarks, and Atlanta’s vibrant nightlife — and more than 125 million people, almost all of them relying on refined products for many aspects of their lives. The East Coast also represents the first of five Petroleum Administration for Defense Districts (PADDs; colored regions in Figure 1). Created in World War II to manage the country’s refined product demand, PADDs now serve the purpose of regionalizing data. PADD 1 (blue region in map on left side of Figure 1 above) is further divided into three regional groupings: PADD 1-A (New England; light-blue area in Figure 2 below), PADD 1-B (Central Atlantic; medium-blue area), and PADD 1-C (Lower Atlantic; dark-blue area).

Figure 2. Map of PADD 1 Sub-Districts and Refineries. Source: RBN

With PADD 1’s population density, it should come as no surprise that the region is the largest consumer of refined products. As shown in the chart on the ride side of Figure 1, demand for petroleum products (blue line) refined from crude oil (primarily gasoline, diesel and jet fuel, and excluding biofuels) has diminished somewhat, from an annual average of 6.3 MMb/d in 2005 to 5.1 MMb/d in 2024. That being said, the PADD’s regional refinery capacity has also been dwindling, which has led to its continued reliance on imported gasoline and diesel, as well as increasing amounts of refined products being piped in from PADD 3 (Gulf Coast) — up by roughly 500 Mb/d since 2010. As those inflows, transported on Colonial Pipeline and Kinder Morgan’s PPL (formerly known as Plantation), have become increasingly important in meeting the region’s needs, it has heightened the risk should a disruption affect either. And we’ve seen that happen in the past, such as the ransomware attack on Colonial (see On The Dark Side) in 2021 or the gasoline leak in Georgia just two weeks ago. (However, as we’ll get to in a moment, flows on those pipelines may decrease significantly as regional demand declines post-2030.)

Join Backstage Pass to Read Full Article