As we step into the new year with record-high U.S. crude oil production and export volumes as strong as ever, there’s a race underway among four offshore export projects that aim to tap into those rising supplies and — with their ability to fully load Very Large Crude Carriers (VLCCs) without any reverse lightering — push export volumes to new heights. While Enterprise Products Partners’ Sea Port Oil Terminal (SPOT) might be leading the development race so far, Energy Transfer’s (ET) Blue Marlin Offshore Port has momentum also. In today’s RBN blog, we update Blue Marlin’s progress, look at the critical role anchor shippers play in project development, and show how growing offshore exports could impact existing onshore terminals.

Before we look at Blue Marlin and the other potential VLCC-ready projects, let’s see how short-term crude oil production is shaping up and how much of that output is likely to be exported. U.S. producers shipped out a little under 4 MMb/d of crude on average last year from production that averaged around 12.9 MMb/d; RBN’s Mid Case production forecast has it rising to 13.3 Mb/d in 2024 and 13.6 Mb/d in 2025. That could swell crude oil exports to 4.2 Mb/d in 2024 and 4.8 MMb/d in 2025, according to RBN’s Future of Fuels report.

There are four main contenders in the race to build a new offshore oil export terminal: Enterprise’s plan to build the Sea Port Oil Terminal (SPOT), ET’s Blue Marlin Offshore Port (BMOP), Sentinel Midstream’s Texas Gulf Link, and Phillips 66 and Trafigura’s Bluewater Texas Terminal. As noted in the introduction, Enterprise’s SPOT project is the furthest along. The Record of Decision (ROD) approving its deepwater port license was awarded by the U.S. Department of Transportation’s (DOT) Maritime Administration (MARAD) in November 2022, three years after the company submitted its application. When the ROD was issued, it was indicated that MARAD would be working with Enterprise to ensure all remaining conditions were met before the deepwater permit was issued. In its most recent 10-K filing, the company said it expected to meet those conditions, which included routine construction, operating and decommissioning guarantees; submission of public outreach, wetland restoration and volatile organic compound (VOC) monitoring plans; and other state approvals in 2023. But it still hasn’t received its permit. That’s how fraught permitting can get, not to mention the costs it can incur. During its analyst day in March 2023, soon after the ROD was issued, Enterprise revealed that its permitting costs for SPOT had already run past $50 million.

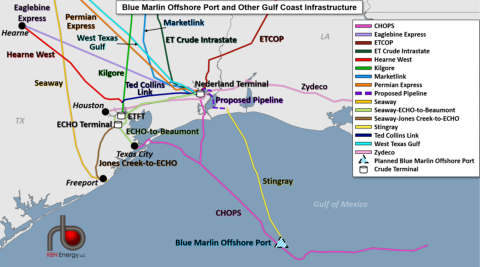

Figure 1. Blue Marlin Offshore Port and Other Gulf Coast Infrastructure. Source: RBN

Join Backstage Pass to Read Full Article