MPLX’s July 31 announcement that it has reached an agreement to acquire Northwind Midstream for $2.375 billion puts a spotlight on two undeniable trends. First, the acquisition is the latest in what by now is a long series of multibillion-dollar deals by midstream giants to expand their Permian-to-Gulf, “wellhead-to-water” networks that gather, process, transport and export crude oil, natural gas and/or NGLs. Second, Northwind has been a pioneer in gathering and processing unusually sour associated gas in the prolific Northern Delaware Basin, an area of particular interest to a growing number of E&Ps. In today’s RBN blog, we discuss the deal and what it brings to MPLX.

First, the 411 — i.e., the details, for some older readers — on the prospective MPLX/Northwind Midstream transaction. MPLX, the midstream-focused master limited partnership formed by Marathon Petroleum in 2012, said it has reached a definitive agreement to acquire Northwind Delaware Holdings LLC (aka Northwind Midstream) for $2.375 billion in cash. MPLX plans to finance the acquisition with debt and expects the deal to close in Q3 2025, subject to customary closing conditions, including clearance under the Hart-Scott-Rodino Act. The company noted in its announcement that it expects the transaction to be “immediately accretive to distributable cash flow and represents a 7X multiple on [MPLX’s] forecast 2027 EBITDA.”

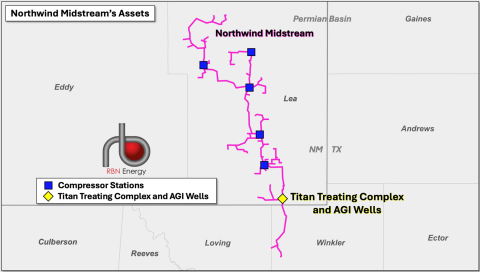

Figure 1. Northwind Midstream’s Assets. Source: RBN

Northwind Midstream, backed by private-equity investor Five Point Infrastructure LLC, was established in 2022 to develop, own and operate “off-spec” gas infrastructure in the Permian. As shown in Figure 1 above, Northwind has developed more than 220 miles of sour-gas gathering pipelines (mostly in Lea County, NM; pink lines), 200 MMcf/d of sour-gas amine treating capacity at its Titan Treating Complex in Lea County (yellow diamond in map; photo below) and two nearby acid-gas injection (AGI) wells with a combined capacity of 20 MMcf/d. (More on all this in a moment.) The gas gathering and treatment system has more than 200,000 dedicated acres and is supported by minimum volume commitments (MVCs) from several leading producers.

Join Backstage Pass to Read Full Article