Twenty-seven LNG cargoes were exported from the U.S. last week, and Europe is still attracting many of these cargoes.

Analyst Insights

Analyst Insights are unique perspectives provided by RBN analysts about energy markets developments. The Insights may cover a wide range of information, such as industry trends, fundamentals, competitive landscape, or other market rumblings. These Insights are designed to be bite-size but punchy analysis so that readers can stay abreast of the most important market changes.

Alberta’s crude oil output in December 2024 reached a record high for any month at 4.26 MMb/d (pink dashed rectangle in chart below), pulling out ahead of the previous record holder set one year ago at 4.19 MMb/d (black dashed rectangle).

In the past two weeks, the price differential for Mars sour crude oil that is delivered from Gulf Coast offshore producing platforms via the Mars pipeline to Clovelly, LA has surged above $1.00/bbl and reached as high as $2.00/bbl on February 3rd (green dashed oval in chart below).

Outflows of natural gas from the Permian Basin were down slightly for the week ending February 10 compared to the week prior. Lower outflows to the West offset higher outflows to the other corridors.

Natural gas storage withdrawals in Canada’s most populous province of Ontario reached their second largest amount on record in January 2025 at 102 Bcf (red column in chart below) according to RBN’s Canadian NatGas Billboar

About 80 % of ethylene in the U.S. is produced from ethane feedstock, so theoretically the price of ethylene should vary with ethane. And ethane, which has two markets – liquid petchem feedstock or rejected into natural gas should see its price vary with the price of natural gas.

As Plaquemines LNG ramps up production of LNG and Golden Pass and Port Arthur LNG inch closer to operation, Louisiana and East Texas are preparing to hit new records for natural gas demand in the coming years.

For the week ending February 7, Baker Hughes reported that the Western Canadian gas-directed rig count was unchanged at 72 (blue line and text in left hand chart below), 19 less than one year ago and holding at the bottom of the five-year range.

US oil and gas rig count increased for the second consecutive week, adding four rigs vs. a week ago and climbing to 586 for the week ending February 7 according to Baker Hughes data.

Summit Carbon Solutions will supply up to 670,000 MT/year of carbon dioxide (CO2) to electrofuels (e-fuels) producer Infinium for a proposed facility in North Dakota or South Dakota, the companies announced February 5.

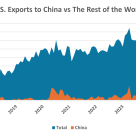

China imposed a 10% import duty on U.S. crude oil on Tuesday in response to the Trump administration's decision to levy an additional 10% tariff on all Chinese goods entering the U.S.

Demand in the Northeastern US during the week ended February 4 decreased by 3.6 Bcf/d from the prior week, with lower demand during and after the weekend as the weather warmed up. Overall, Northeast demand averaged 29.2 Bcf/d.

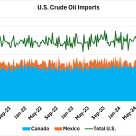

Total U.S. crude imports increased by 470 Mb/d to 6.915 MMb/d, with Canadian supplies rising by 350 Mb/d and once again surpassing 4 MMb/d. This rise could be attributed to companies trying to import as much Canadian crude oil as possible ahead of the tariffs discussed last week.

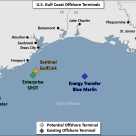

It’s been a long road for Enterprise Product Partners’ Sea Port Oil Terminal (SPOT), but it looks like the journey may be coming to an end—at least for now.

The EIA reported total U.S. propane/propylene inventories had a withdrawal of 4.8 MMbbl for the week ended January 31, which was more than industry expectations for a decrease of 3.5 MMbbl and above the average draw for the week of 3.2 MMbbl. Total U.S.

The price of propane is up slightly to about 53% the price of NYMEX crude. This is the highest the ratio has been since April 2022 when it averaged about 54%.

U.S. crude oil exports averaged 3.8 MMb/d last week, up 324 Mb/d from the prior week, recovering from Winter Storm Enzo, which impacted the Gulf Coast the prior week. Exports last week aligned with the year-to-date average.

The U.S. exported more than 100 LNG cargoes to Europe in January, a record for exports from the U.S. to the continent.

Exports to Europe accounted for more than 80% of total U.S. LNG cargoes during the month, above typical levels as European storage woes increased demand for cargoes.

Production of natural gas in the Permian Basin was back at its pre-freeze off level all week after being reduced from January 19 through January 22. Production ranged from 20.32 Bcf/d to 20.57 Bcf/d and averaged 20.46 Bcf/d for the week ended February 3.