The U.S. is now the world’s #1 supplier of LNG and the new liquefaction/export capacity slated to come online over the next few years suggest it will hold that position into the 2030s. To control more of the LNG value chain and become more familiar with the inner workings of the U.S. natural gas market, a small-but-growing number of LNG buyers and suppliers have been acquiring gas production assets close to LNG export terminals along the U.S. Gulf Coast — in other words, buying slices of the American gas-supply pie. In today’s RBN blog, we discuss the LNG market players pursuing this strategy, what they’ve been buying, and how their acquisitions may benefit them.

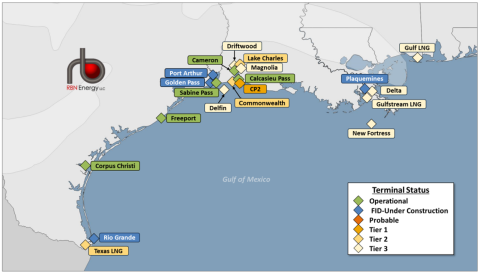

Last month, in We Three Kings, we looked at the “LNG Trinity” — the U.S., Qatar and Australia — that account for about 60% of global LNG production and imports. We noted there that the U.S. exported 84.5 million metric tons per annum (MMtpa) of LNG in 2023, the gas equivalent of 11.2 Bcf/d, and that the LNG projects with a final investment decision (FID) and under construction in Texas and Louisiana (blue diamonds in Figure 1 below) will increase U.S. LNG export capacity by 80% by 2028. Still, more projects may advance next year, assuming President-elect Trump lifts the Biden administration’s January 2024 pause on new Department of Energy (DOE) gas-export approvals.

U.S. Gulf Coast LNG Export Facilities

Figure 1. U.S. Gulf Coast LNG Export Facilities. Source: RBN’s LNG Voyager

A key link in the LNG value chain is gas supply — that is, the acreage, wells and gathering systems in the Haynesville, the Eagle Ford and other U.S. production areas that churn out and gather the massive volumes of gas that feed the facilities that liquefy gas and load it onto large LNG carriers for shipment overseas. Most of that feedgas — and the pipeline capacity needed to deliver it — are procured under long-term contracts between liquefaction-plant owners and gas producers and/or marketers. In some cases, however, LNG suppliers and buyers — like the ones detailed below — have been acquiring and developing their own gas production assets, largely to reduce gas-supply costs and mitigate the effects of gas-price volatility.

Join Backstage Pass to Read Full Article