About 60% of global LNG imports in 2023 came from only three countries — Australia, Qatar and the U.S. — sometimes dubbed the “LNG Trinity.” All three are geographically remote from each other and differ considerably in terms of configuration, politics, economics and strategy. But all three are looking to consolidate and potentially grow their global presence at a time when expectations regarding future LNG demand are evolving and the role of natural gas is shifting to become increasingly complementary to intermittent renewable sources. In today’s RBN blog, we look at the differences within the LNG Trinity and how they may impact — and be impacted by — developments in the global gas market.

Historically, the first of the LNG Trinity was Australia, which commenced LNG production from the North West Shelf (NWS) project in 1989. This project (large blue circle to far left in Figure 1 below) receives gas volumes from the North Rankin and Goodwyn fields, including significant condensate volumes. The project structure is an unincorporated joint venture (JV) whereby each of the six equity partners sells its one-sixth share of LNG to eight Japanese utility buyers, totaling 48 sales and purchase agreements (SPAs). [The six partners in the project were BHP (later acquired by Woodside), BP, Mitsubishi, Mitsui, Shell and Woodside (operator).] The project has been expanded in several phases to reach a capacity of 16.3 million MT per annum (MMtpa), or around 2.2 Bcf/d, and is notable for its 25-year contract with the CNOOC-controlled Guangdong Dapeng LNG Co., which commenced in 2006 (see China In Your Hand). It was the first long-term LNG contract into China and priced at a level well below contemporary agreements, including a price cap, which has resulted in a delivered price of around $4/MMBtu — which looks like a Black Friday bargain today.

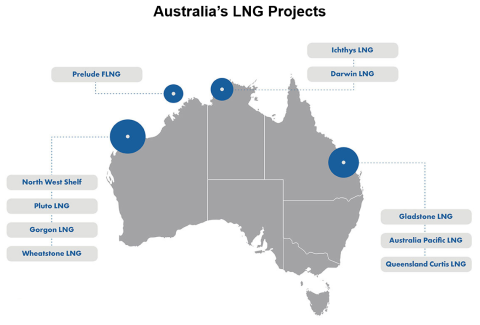

Figure 1. Australia’s LNG Projects. Source: Energy Information Australia

From the beginning, a feature that the Japanese buyers found particularly appealing about the NWS project was the absence of a national oil company (NOC) in the shareholder mix. The reason for this derives from LNG pricing disputes during the mid-1980s. When crude oil prices fell to less than $10/bbl in 1986, all LNG contracts supplying Japan were indexed to the official government selling price (OGSP) of the supplying country, not to spot or market-derived prices. OGSPs were around $30/bbl when oil was actually trading for less than half that. The Japanese buyers objected but continued to pay the contract price for months before forcing the supplier projects — such as Abu Dhabi, Brunei and Malaysia — to renegotiate the price formula to reflect the market price of LNG. This is how LNG contracts thereafter became indexed to the Japanese Customs Cleared (JCC) price — often incorrectly called the Japanese crude cocktail — the price paid and reported by Japanese oil importers.

Join Backstage Pass to Read Full Article