Even as many countries and companies around the world continue to ramp up their use of wind and solar power and explore the potential for a variety of renewable, low-carbon and no-carbon fuels, there’s a growing acknowledgment that natural gas — imperfect as it may be from a climate perspective — will remain a significant part of the global energy mix for decades to come. So why not make natural gas as clean as it can be by reducing emissions of methane — gas’s primary component and a particularly potent greenhouse gas? That’s the driver behind the certified gas movement, the focus of a new Drill Down Report that we discuss in today’s RBN blog.

First, a definition: Certified natural gas is gas that an independent third party has verified as being produced, gathered, processed, transported and/or distributed in a way that meets higher environmental standards or, more specifically, has a demonstrably lower methane intensity, or MI. For the most part, the certified gas movement has focused on the upstream end, namely where gas is produced, either in gas-focused plays like the Marcellus/Utica and the Haynesville or crude-oil-focused plays like the Permian and the Bakken, where large volumes of associated gas (a mix of methane, NGLs and various impurities) emerge from wells with crude oil.

The global push to slash methane emissions from upstream operations (and, to a lesser extent so far, from midstream and downstream operations) and certify gas as having significantly lower MI has been accelerating and broadening. It now seems possible that within a couple of years the majority of gas produced in the U.S. will be certified as being low-MI, and that increasing numbers of gas buyers — power generators, industrials, LNG exporters and local distribution companies (LDCs) among them — will be insisting on certified gas, or at least moving toward doing so. Further, a certified gas market is developing (a handful of trading platforms have already been launched), as are tracking systems to ensure that gas sold as certified is fully accounted for and legit, with no double-counting or fuzziness.

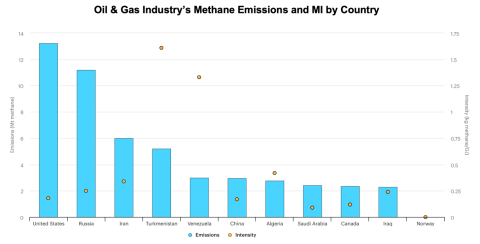

Let’s acknowledge three things up front. First, for either certified or plain-old natural gas, the volumes of methane, carbon dioxide (CO2), and other greenhouse gases (GHGs) generated from the production wellhead to the point where the gas is to be burned pale in comparison with the massive volumes of GHGs released by the combustion of that gas by end-users. For that reason, many environmental activists openly question the real value of certified gas. (Some also question the efficacy of various methane-detection devices.) Second, there’s the physical reality that while a producer, a pipeline company, and an LNG producer or LDC may reach a deal to supply, deliver, and receive X amount of certified gas per day, that lower-MI gas is blended in the pipeline with “non-certified” gas from other sources and the end-user in fact receives a mix of certified and non-certified gas molecules. Third, while the International Energy Agency (IEA) says the U.S. oil and gas industry emits more methane into the atmosphere than its counterparts in any other country (blue bars and left axis in Figure 1 below), that’s largely because the U.S. is far and away the largest producer. Yet, the MI of its operations (gold dots and right axis) are among the lowest, in part because of concerted efforts by U.S. producers to detect and repair leaks and thereby maximize the amount of gas that can be sold.

Figure 1. Oil & Gas Industry’s Methane Emissions and MI by Country. Source: IEA

Join Backstage Pass to Read Full Article