Six months ago, the U.S. West Coast natural gas market looked like it was in dire straits. A harsh winter had depleted stocks to the lowest level in over a decade and it seemed like the region would be hard-pressed to refill storage to a reasonable level, given limited and constrained pipeline options to flow incremental gas west. Instead, a combination of mild weather and operational changes eased demand and pipeline constraints, and Pacific Region storage staged a remarkable comeback this summer. In today’s RBN blog, we delve into how the region escaped a worst-case scenario heading into the heating season.

For years now, transportation constraints for moving gas west of the Rockies and reduced gas storage capacity on the West Coast have been driving a wedge between the U.S.’s Western and Eastern gas markets (see Wild, Wild West). The West Coast gas market has been at the forefront of the energy transition; nevertheless, natural gas transportation constraints and gas supply shortages in the region, particularly California, have made it the highest-priced gas market in the country. The Golden State has experienced radical shifts for the better part of the past decade, from the permanent shutdown in 2013 of the 2,250-MW San Onofre nuclear facility (see Play Me a Songs Mr. Generator Man and California Schemin’) — a major power source for the Los Angeles metro area — to an aggressive expansion of renewable energy (first wind, then a lot of solar; see Here Comes the Sun and California Dreamin’), and capacity reductions at SoCalGas’s Aliso Canyon gas storage facility stemming from a leak in 2015 (more on that in a bit).

These changes have made the region vulnerable to gas shortages, transportation and storage constraints, power outages and price spikes, even as gas supply abundance east of the Continental Divide has tamped down prices in the Central and Eastern markets. Without new westbound pipeline capacity, markets west of the Permian Basin have been hard-pressed to take advantage of the supply growth in West Texas and have struggled to consistently maintain adequate natural gas supplies.

We’ve seen the fundamental and pricing dislocations resulting from this “Great East-West Divide” a number of times over the past several years, triggered primarily by extreme weather and/or extended pipeline outages (see Electrical Storm, Chain Reaction and Baby I Need Your Gas). They were also on full display last winter.

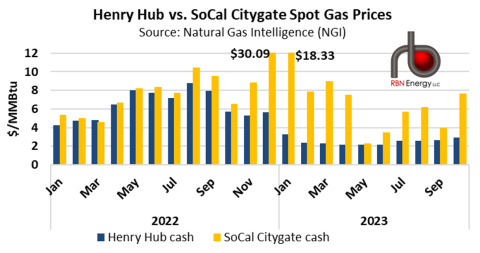

Spot prices at SoCal Citygate (yellow bars in Figure 1) had been averaging less than $1/MMBtu above the national benchmark Henry Hub. However, the SoCal premium expanded last winter as citygate prices surged to an average of $30/MMBtu in December and averaged nearly $15/MMBtu for the full winter — nearly triple the previous winter’s price and the highest on record for that period. Other California and West Coast markets saw similar price spikes. By comparison, winter prices at national benchmark Henry Hub (navy blue bars) collapsed from last summer’s peak of nearly $10/MMBtu to the $2/MMBtu territory by January and averaged $2.77/MMBtu for the full winter.

Figure 1. Henry Hub vs. SoCal Citygate Spot Gas Prices. Source: NGI

Join Backstage Pass to Read Full Article