After languishing since midsummer, the share prices of U.S. oil and gas producers surged after Election Day on a wave of optimism that the sector would flourish under the new administration. However, stocks quickly gave up most of the gains on lackluster Q3 2024 results and a great deal of uncertainty about how — or even if — President-elect Trump’s oft-quoted goal to “drill baby drill” to lower energy costs would impact the strategies and results of the publicly traded E&Ps, especially the 15 major Oil-Weighted producers we cover. In today’s RBN blog, we delve deeper into the impact of the Q3 results of the oil producers on shareholder returns, cash allocation, leverage and capital investment, including the first announcements of 2025 budgets.

In our first blog on Q3 2024 earnings, Who’ll Stop The Rain, we explained that softening oil prices have eroded profits and cash flows since early 2023. The average realized price for the Oil-Weighted peer group fell 8% to $45.12/boe in Q3 2024, triggering a 12% decline in pre-tax operating profits to $17.63/boe, slipping below the $20/boe mark for the first time since 2020. Cash flows were 8% lower at $31.82/boe.

However, all 15 companies in the peer group remained profitable during the quarter. A major factor was a continuing emphasis on efficiency, as producers lowered lifting costs by a significant 7% in Q3 2024. As we’ll explore in this blog, companies have ratcheted down the percentage of cash flows allocated to organic finding and development (F&D) activities, concentrating on their highest-margin assets. The tactics have allowed them to sustain historically elevated dividend and share-repurchase programs, although the volume of shareholder returns has fallen since the post-pandemic peaks in late 2022 and early 2023. At the same time, spending has soared on acquisitions aimed at high-grading portfolios to increase efficiency and boost margins.

As we’ll discuss, M&A activity has increased leverage. That means financial discipline, a continued focus on shareholder returns, and maintaining solid balance sheets will be fundamental for sustaining investor support, especially amid recent concerns about oil price volatility.

Shareholder Returns

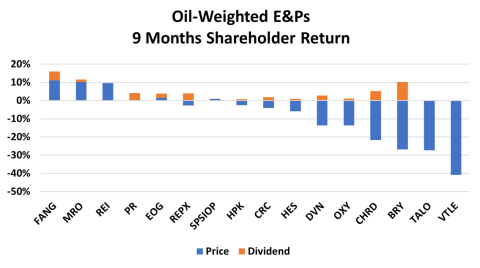

The decline in oil prices has raised some investor concern. The S&P E&P index (SPSIOP) began sliding after an April 2024 peak and the reduction accelerated in the second half of the year, bottoming out in mid-September at a 30% reduction from the end of Q2 2024. So it’s no surprise that in the first nine months of 2024, the Oil-Weighted E&Ps posted a -2% median total shareholder return, which is calculated by combining dividends (orange bar segments in Figure 1 below) with gains or reductions in the share price (blue bar segments). Six of the 15 companies in the peer group posted a positive return.

Figure 1. Oil-Weighted E&Ps Shareholder Return, Nine Months Ending September 30, 2024.

Source: Oil & Gas Financial Analytics, LLC

Join Backstage Pass to Read Full Article