Boosting America’s hydrocarbon output was a major plank in the 2024 Republican platform, and Donald Trump’s recent victory has stimulated a lot of optimism about the U.S. upstream sector. The nomination of Liberty Energy CEO Chris Wright as Energy Secretary confirmed that “drill, baby, drill” will be a mantra in the new administration. However, over the past few years, U.S. producers have dramatically shifted their focus from growth at any cost to strict financial discipline focused on maximizing free cash flows and shareholder returns. In today’s RBN blog, we analyze the Q3 2024 results of the major U.S. E&Ps we follow and look for early clues about how their senior executives might react to the renewed federal enthusiasm to rapidly accelerate drilling.

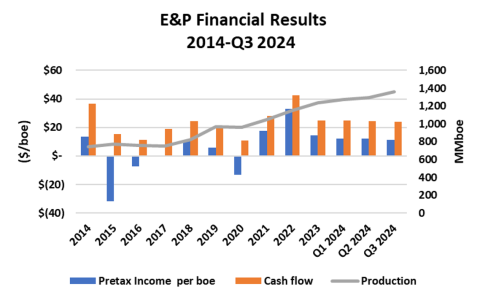

We begin with a reminder that producers were financially brought to their knees in early 2020 after a steep commodity price decline in late 2019 that bottomed out after the onset of the pandemic. Investors fled the oil and gas industry in droves and equity prices fell 95% from their 2014 highs. Survival necessitated the shift in strategy from growth to fiscal discipline, which was implemented by E&P executives heavily incentivized by bonus criteria that tied compensation to rates of return rather than reserve and production growth. Thanks to a surge in post-pandemic commodity prices, cash flows soared and investors flocked back to an industry that suddenly offered total returns nearing or exceeding 10%. Although prices have retreated from 2022 highs, the industry is still generating cash flows of more than $20 per barrel of oil equivalent (boe) produced. As shown by the orange bars and left axis in Figure 1 below, this level is still significantly higher than the results in 2015-20.

Figure 1. E&P Financial Results and Production, 2014-Q3 2024.

Source: Oil & Gas Financial Analytics, LLC

However, Q3 2024 results show that weakening oil prices are eroding profits (blue bars and left axis) and cash flows. The average WTI crude oil price slid nearly 7% in Q3 2024 to $75.26/bbl and exited the quarter at just above $70/bbl. The dip was partially offset by a bump in natural gas prices from summer lows, but the average realized price for the 39 E&Ps we follow fell 5% to $35.82/boe, the lowest since Q2 2023. That translated into a 5% reduction in cash flow at $23.97/boe. Pre-tax operating income fell 17%, heavily impacted by a $1.1 billion impairment charge by APA Corp. The declining results were mirrored by a 4% decline in the S&P E&P index, as investor sentiment has been closely tied to oil prices.

Join Backstage Pass to Read Full Article