President-elect Trump’s plan to impose a 25% tariff on all imported goods from Canada and Mexico — including crude oil — has raised concern among U.S. refiners, many of which depend heavily on those imports and would face serious challenges in replacing them. The question is, given that dependence and the incoming administration’s pledge to reduce energy costs, will refiners — and oil producers in Canada and Mexico — succeed in their efforts to exempt crude oil from the tariff plan? In today’s RBN blog, we discuss the degree to which U.S. refineries incorporate Canada- and Mexico-sourced oil in their crude slates, the potentially devastating impacts of a tariff on Canadian crude in particular, and the odds for and against U.S. tariffs on oil imports from its neighbors.

It’s been a busy few weeks for the Trump 2.0 transition team. Just days after his reelection on November 5, the once and future president put forward Doug Burgum, governor of North Dakota (#3 among the states in U.S. oil production) as his Interior Secretary and Chris Wright, founder and CEO of Liberty Energy (a leading hydraulic fracturing and proppant sand logistics company) as his Energy Secretary designee. Both are viewed as strong advocates of expanded U.S. energy production. But on November 25, President-elect Trump said that on January 20, 2025 — his first day in office — he would impose a 25% tariff on all imported goods from Canada and Mexico, including crude oil and natural gas. The incoming president added that he would keep the tariffs in place until the U.S.’s neighbors to the north and south stopped the flow of illegal drugs (especially fentanyl) and illegal immigrants.

Canada

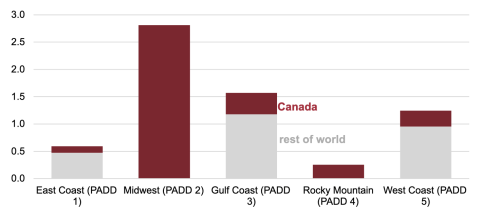

The potential impact of a big bump-up in the delivered cost of imported Canadian crude in particular is enormous. From 2009 to 2023 — a 15-year period during which production soared in both U.S. shale plays and the Alberta oil sands — U.S. imports of Canadian crude doubled, from just over 1.9 MMb/d to nearly 3.9 MMb/d, according to the Energy Information Administration (EIA). As shown by the dark-red bar segments in Figure 1 below, the vast majority of Canadian imports have flowed to refineries in PADD 2 (Midwest), a number of which have upgraded their operations to enable the refining of favorably priced, harder-to-process, heavy (low-API) crude oils like those produced in the oil sands. Smaller volumes of Canadian crude are either piped, railed or transported by marine vessels to refineries in PADDs 1 (East Coast), 3 (Gulf Coast), 4 (Rockies) and 5 (West Coast). While refineries in PADD 4 are also highly dependent on crude imports from Canada, most crude imports into PADDs 1, 3 & 5 are from other sources (gray bar segments).

U.S. Imports of Crude Oil by Origin in 2023 (in MMb/d)

Figure 1. U.S. Imports of Crude Oil by Origin in 2023 (in MMb/d). Source: EIA

Join Backstage Pass to Read Full Article