It looks like the U.S. ethane market may have just dodged a bullet. Since late May, the U.S. Bureau of Industry and Security effectively banned ethane exports to China, the destination for two-thirds of the ethane sent out of Gulf Coast docks — about 225 Mb/d in 2024. Ethane has become a bargaining chip in U.S.-China negotiations over rare earths and tariffs, in part because China has no alternative source of waterborne ethane feedstock for its petchems. But playing the ethane card presented a potential problem for the U.S. too. While China isn’t the only export market for U.S. ethane, there are very limited other destinations for the volumes they typically take. The need to find a home for those volumes could have required significantly more “rejection” of ethane into natural gas at U.S. gas processing plants — i.e., selling ethane for its fuel value instead of recovering it for petchems or export. In today’s RBN blog, we examine the ethane export issue, which remains in flux as part of the broader U.S.-China trade agreement still being finalized.

We’ll begin with the big news: On June 10, U.S. and Chinese negotiators reached a tentative framework aimed at defusing the latest round of trade tensions between the two countries. According to reports, the draft agreement includes revised tariff rates, a six-month relaxation of Chinese export license requirements for rare earth elements, and reciprocal easing of U.S. export restrictions on semiconductor technology. There are a few other provisions in the tentative deal. Most important for the ethane market, the deal framework would lift the effective U.S. ban on ethane exports to China — a critical development given the importance of China to the global ethane market. Here’s the story of how the ban could have backed up U.S. ethane.

The Shale Revolution has had many effects on U.S. energy production, but one of the most dramatic and far-reaching has been the unprecedented growth in the volumes of ethane emerging from wells along with other NGLs, crude oil and natural gas. As we have blogged about extensively over the years, ethane — aka C2 because it has two carbon atoms (plus six hydrogen atoms) — is the quirkiest NGL for at least two reasons. First, it can either be “rejected” into natural gas and sold for its Btu value or separated (with other NGLs) from natural gas at processing plants and then fractionated into liquid ethane for use as a feedstock in steam crackers to make ethylene and other petrochemicals. Second, fractionated ethane — unlike the other NGLs – propane, butanes and natural gasoline — has (with very limited exceptions) only that one use, as a petchem feedstock.

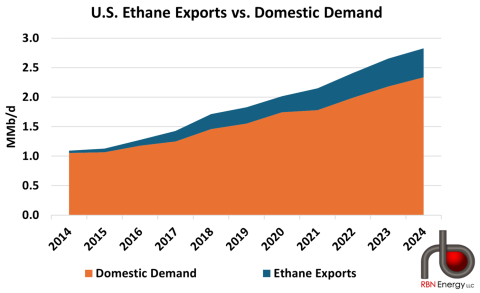

Note that, like the other NGLs, ethane is a byproduct of natural gas production, which likewise can be primarily a byproduct of crude oil production in some oil-centric basins like the Permian and the Bakken. That means that ethane gets produced regardless of its price! It comes out of the ground as part of a comingled stream, is extracted in a nearby gas processing plant, and then is, in almost all cases, transported by pipeline in the form of a Y-grade mix to a centralized fractionator that splits the mix into ethane and the four other purity NGL products. In 2024, U.S. fractionators churned out about 2.8 MMb/d of ethane; we estimate that another 1 MMb/d of ethane was rejected at processing plants into natural gas and sold as gas. (Much more on ethane rejection later.)

As shown in Figure 1 below, of the 2.8 MMb/d that was extracted from gas and produced as liquid ethane last year, about 2.3 MMb/d (or ~82%; orange layer) was piped to U.S. steam crackers, many of them built over the past few years to take advantage of the flood of cheap domestically sourced ethane coming their way. The other 500 Mb/d (or ~18%; blue layer) of produced ethane was exported, with more than two-thirds of those exports (~70%, or about 350 Mb/d) being shipped out of Enterprise’s Morgan’s Point, TX, export terminal near Houston and Energy Transfer’s Orbit terminal in Nederland, TX. The other 30% was either piped north to petchem plants in Canada or shipped out of Energy Transfer’s Marcus Hook terminal near Philadelphia. Most of the ethane exports out of Texas went to Asia (smaller volumes went to Europe and Latin America), while most of the exports out of Marcus Hook went to Europe.

Figure 1. U.S. Ethane Exports vs. Domestic Demand. Source: EIA

Join Backstage Pass to Read Full Article