Located just east of the prolific Eagle Ford shale, production from the Eaglebine play has yet to take off. In good part that is because takeaway capacity is currently limited to trucks. All that is about to change with the new 60 Mb/d Sunoco Logistics Eaglebine Express pipeline due online by the end of 2014. And last month two midstream companies announced competing pipeline projects that would add as much as another 400 Mb/d of takeaway capacity in 2016. Today we review recent developments in the Eaglebine basin.

The Eaglebine

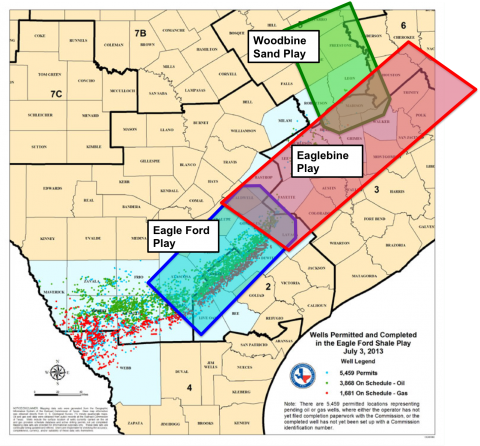

We previously covered the up and coming Eaglebine play just over a year ago in July 2013 (see We Heard it Through the Eaglebine). The Eaglebine play is located on the northeastern trend of the Eagle Ford where the Eagle Ford Shale meets the Woodbine Sandstone. The map below shows the approximate location of the Eaglebine (red shaded area) relative to the eastern part of the Eagle Ford (blue shaded area) and the southern tip of the Woodbine (green shaded area). The main counties where drilling has occurred in the Eaglebine are Leon, Madison, Brazos, Grimes, Walker and Polk. The Eaglebine formation has been more complex for drillers to exploit than the Eagle Ford with many layers of source rock. However, the play has high hydrocarbon potential including a mixture of oil and condensate liquids. The Eaglebine formation can exceed 1000 feet in thickness and is found at depths between 6,500 and 15,000 feet.

Figure #1

Source: Texas Railroad Commission, RBN Energy (Click to Enlarge)

In spite of quite a lot of producer hype, actual production of oil and condensate in the Eaglebine has been slow to increase – at least according to the Texas Railroad Commission (TRC). TRC production data for the counties listed above shows that conventional drilling was producing about 15 Mb/d in January 2010 and that more than doubled to over 30 Mb/d in the Summer of 2013 but has fallen back to the mid-20’s this year. These number pale into insignificance compared to the Eaglebine’s near neighbor the Eagle Ford that has come from nowhere in 2010 to producing over 1.5 MMb/d of crude and condensate this year. Nevertheless the indications are that consolidation of assets by early players, farming in by big producer EOG (that has a joint venture with early entrant Zaza Energy) and drilling by the likes of Apache and Anadarko mean the Eaglebine has strong potential. That should be translated into higher production next year as a result of an increase in 2014 drilling.

Join Backstage Pass to Read Full Article