One of today’s hottest boutique oil shale plays in Texas is located northeast of the Eagle Ford shale and south of the Woodbine Sand basin. This play has been dubbed the “Eaglebine” by one of its principal acreage holders – ZaZa Energy Corporation. Another part of the play – operated by Halcón Resources - is known as “El Halcón” (the Hawk). Both companies are confident that positive early drilling results will translate into high rates of return. Today we examine the Eaglebine play.

|

Check out Kyle Cooper’s weekly view of natural gas markets at |

Eagle Ford and Woodbine Sands

The Eagle Ford is a sedimentary shale rock formation stretching 400 miles from just northwest of Houston, to an area south of San Antonio and all the way into Mexico. The shale lies between 4000 and 14,000 feet below the surface. The core liquids rich areas in Karnes, DeWitt and Gonzales counties are producing some of the highest returns in the US. Eagle Ford oil has helped power the boom in US shale over the past two years. Production is estimated at 1 MMB/d by Bentek (July 2013) and now surpasses volumes produced in the North Dakota Bakken field. We have reported on growing Eagle Ford production and infrastructure to transport oil to Gulf Coast markets (see Knocking on Heaven’s Door) as well as the preponderance of super light condensate production from the play (see The Eagle Ford Condensate Challenge).

The Woodbine Sand is the productive reservoir for the huge 6 billion Bbl East Texas oil field first exploited in the 1930’s that was the largest oilfield in the world in it’s time. The Woodbine has largely been exploited using conventional vertical drilling technology but in recent years a number of companies have successfully applied horizontal drilling and hydraulic fracturing technology in the South East Texas part of the formation.

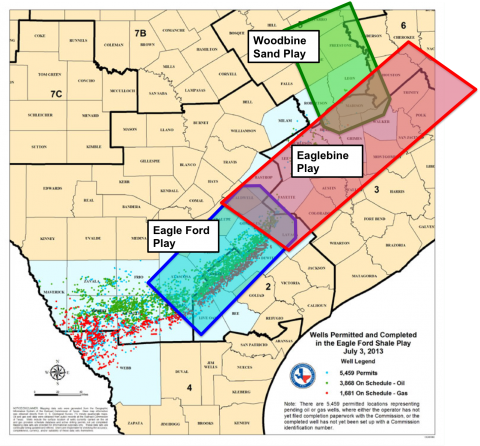

The Eaglebine play is located on the northeastern trend of the Eagle Ford where the Eagle Ford Shale meets the Woodbine Sandstone. The Eaglebine and Eagle Ford share similar geology, as they are both situated above the Buda Formation and below the Austin Chalk. However, the Eagle Ford is a carbonate rich organic, while the Eaglebine contains a large percentage of silca-rich sands interlaced in the organic rich shale. This makes the Eaglebine formation complex to exploit with many layers of source rock, high hydrocarbon potential but like the Eagle Ford a mixture of oil and condensate liquids. The Eaglebine formation can exceed 1000 feet in thickness and is found at depths between 6,500 and 15,000 feet. The map below shows the approximate location of the Eaglebine (red shaded area) relative to the eastern part of the Eagle Ford (blue shaded area) and the southern tip of the Woodbine (green shaded area). The main counties where drilling has occurred in the Eaglebine are Leon, Madison, Brazos, Grimes, Walker and Polk.

Source: RBN Energy and Texas Railroad Commission (Click to Enlarge)

Development

Unconventional activity in the Woodbine part of the play started in Madison County, where early-movers like PetroMax and Woodbine Acquisition drew attention with 1,000 b/d and higher initial production (IP) rates. Halcón Resources Corp. is the most active operator in this part of the Eaglebine with six rigs on the ground and a 270 thousand acre position. Halcón is a small but growing company run by the former principals of Petrohawk Energy Corp (now owned by BHP Billiton) who were pioneers in the Eagle Ford. Halcón’s biggest success in the Woodbine Sands has come from the Halliday Field in Leon County where their first 14 wells this year (2013) had an IP rate of 440 barrels of oil equivalent (BOE). The drilling and completion cost was about $6.5 MM per well and estimated ultimate recovered liquids (EUR) were 562 MBbl – a 130 percent IRR for $90/Bbl oil (source: Oil and Gas Investor, June 2013).

In April of this year Halcón began targeting the Eagle Ford shale part of the Eaglebine in Brazos county – developing their 50,000 acre El Halcón (“The Hawk”) field. Two producing wells completed in 2013 averaged 1,028 BOE IP’s and are 90 percent oil. These wells have a 370 MBbl EUR drilled for $7.5 MM each – a 60 percent IRR at $90/Bbl oil (Oil and Gas Investor). More significantly Halcón says that the oil quality is 40 API degrees meaning that it is similar in quality to the US benchmark West Texas Intermediate (WTI). That compares favorably to much of the Eagle Ford production, which has a higher API (over 50). Higher API Eagle Ford production is frequently discounted because US refineries are not typically configured to process such light crude or condensate (see Fifty Shades Lighter – What Should be Done With Condensate). Producing 40 API “Hawk” crude this close to Houston should improve the producer’s rate of return compared to other shale plays.

Join Backstage Pass to Read Full Article