The fact is, many major E&P acquisitions include at least some production assets that don’t align with the acquiring company’s long-term strategic plans. Also, it’s often true that big-dollar M&A increases the buyer’s debt level — and it’s typical in such cases that the company commits to quickly reducing its debt through the divestiture of non-core assets. As we discuss in today’s RBN blog, there’s a lot of that going on now, and in many cases smaller, private-equity-backed producers are scooping up the acreage and production being sold.

Through the first half of the 2020s there’s been a frenzy of upstream M&A activity in the U.S., with a good number of deals valued in the billions or even tens of billions of dollars. Earlier this week, for example, Crescent Energy announced plans to acquire Permian producer Vital Energy for $3.1 billion in stock. Just over a year ago, Crescent closed on the $2.1 billion, stock-and-cash purchase of SilverBow Resources, a leading E&P in the Eagle Ford, and in January, Crescent bought more Eagle Ford acreage and production from Ridgemar Energy for $905 million. (More on Crescent in a moment.)

Or consider Pioneer Natural Resources, which followed up several years of mostly organic growth with the 2021 purchases of Parsley Energy (for $7.6 billion) and DoublePoint Energy (for $6.5 billion; see Buy Buy Buy for more on the deals), only to be gobbled up by an even bigger fish, ExxonMobil, in May 2024 for a cool $64.5 billion (including the assumption of Pioneer debt). Since then, ExxonMobil has worked to reduce its debt, in part through (you guessed it!) the sale of non-core assets.

ConocoPhillips

The same has been happening at ConocoPhillips, which made headlines last year with its $22.5 billion acquisition of Marathon Oil. As we discussed in Everybody Dance Now, the real gems in the deal for ConocoPhillips were Marathon’s highly complementary production assets in the Eagle Ford, the Bakken, and the Permian’s Delaware Basin. The transaction also gave ConocoPhillips the greater scale it needed to compete with the likes of ExxonMobil and appeared to be the best option for Marathon, which was probably too small to be a major acquirer.

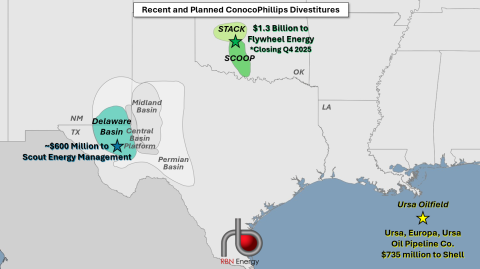

Marathon also came with something ConocoPhillips didn’t see fitting into its long-term strategy: about 300,000 net acres in the Anadarko, more specifically natural-gas-focused assets in the SCOOP/STACK play in Oklahoma that have been producing about 40 Mboe/d in recent months — one-quarter of that (or about 10 Mb/d) in the form of crude oil. ConocoPhillips announced August 7 that it has reached an agreement to sell those assets (green star in Figure 1 below) to an undisclosed buyer for $1.3 billion. According to published reports, the purchaser is Flywheel Energy, a privately held, Oklahoma City-based E&P backed primarily by energy-sector investor Stone Ridge Energy. The deal is expected to close in Q4 2025.

Figure 1. Recent and Planned ConocoPhillips Divestitures. Source: RBN

Join Backstage Pass to Read Full Article