Taking a nine- or 10-figure energy infrastructure project from concept to fruition is never easy. Siting dilemmas, permitting woes, commitment-wary customers, financing snags, legal challenges — there are seemingly endless hurdles. And that’s in normal times. Add in market volatility and fast-changing governmental policies and a developer’s job becomes darn-near impossible. In today’s RBN blog, we discuss midstream companies’ uphill battle in advancing infrastructure projects in 2025, focusing on a recently announced greenfield natural gas storage project along the Texas Gulf Coast.

As we said in our Drill Down Report on Gulf Coast gas storage last fall, rising demand for storage — and, just as important, rising storage values — have spurred a number of midstreamers to either expand their existing facilities in the region or enter the space with acquisitions or plans for greenfield projects. The key driver is that, unlike in the old days, when the storage market was driven primarily by the intrinsic value of capacity — i.e., the need to sock away gas in the lower-demand summer months for use in the peak winter months — the value of storage today is being driven mostly by extrinsic economics — i.e., how flexible and responsive capacity allows market participants to manage supply and demand week by week, day by day and even hour by hour.

This is especially true along the Gulf Coast, where rising gas production, increasingly undulating demand for gas (tied in part to the ups and downs of wind and solar power), frequent extreme weather events, new LNG export capacity, and plans for tens of thousands of megawatts (MW) of new gas-fired power generation (for expanding power grids as well as for data centers) have been increasing the value of gas storage or, more specifically, the merit of quickly injecting and withdrawing gas to respond to market swings — and, for LNG export terminals in particular, the need to quickly divert scheduled gas deliveries to storage if liquefaction capacity trips offline.

There’s a catch, though: To get any project off the ground, storage values need to be high enough to support project development costs, and prospective customers considering multiyear commitments need to have a high degree of confidence that their investment can be justified over the long haul.

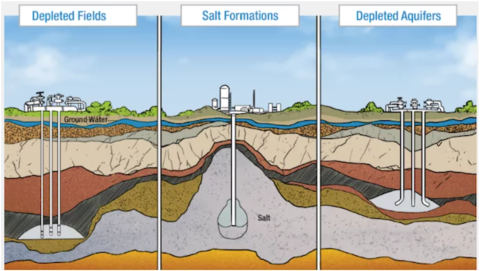

Types of Natural Gas Storage Facilities

Figure 1. Types of Natural Gas Storage Facilities.

Sources: American Gas Association and American Petroleum Institute

Join Backstage Pass to Read Full Article