Enterprise Products Partners continues to grow its export capabilities and set ambitious goals, including one noted by CEO Jim Teague during his appearance at RBN’s recent NACON: PADD 3 conference — growing liquid hydrocarbon exports by about 50% to a remarkable 100 MMbbl per month (100 MMb/month), or about 3.33 MMb/d. And that doesn’t include the company’s planned Sea Port Oil Terminal (SPOT), which could send out up to 2 MMb/d! While that goal may seem lofty, Enterprise is already a major player in export markets and has extensive hydrocarbon delivery, storage and distribution assets in place to feed its coastal terminals. In today’s RBN blog, we look at the crude oil side of Enterprise’s export machine and show why supply will be key to meeting part of that ambitious goal.

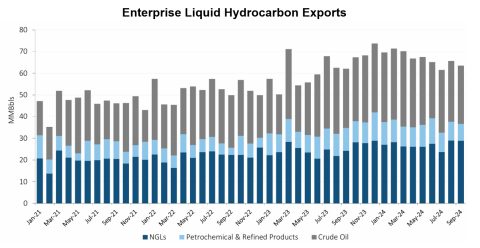

While Enterprise hasn’t spelled out how it intends to ramp up its liquid exports, we’ll walk you through one scenario on how it might all shake out. Let’s start with the big picture. For the first nine months of 2024, Enterprise reported that it was exporting nearly 67 MMb/month (2.2 MMb/d) of liquid hydrocarbons (average of last nine stacked bars to far right in Figure 1 below), with crude oil (gray bar segments) accounting for 30.2 MMb/month (992 Mb/d), NGLs (dark-blue bar segments) adding another 27 MMb/month (886 Mb/d), and refined products and petchems (light-blue segments) contributing 9.6 MMb/month (315 Mb/d). To move combined exports from 2.2 MMb/d to 3.33 MMb/d would require a jump of about 50%, or about 1.1 MMb/d. For the sake of this blog series exploring the company’s export assets, let’s assume as a starting point that the share of exports from each group will remain essentially constant, as it has since January 2021, although NGL volumes might be likely to grow more than crude oil due to Enterprise’s new gas processing plants in the Permian and new dock capacity being built in Neches River and Houston. An across-the-board increase of 50% would push crude oil exports to nearly 1.5 MMb/d, NGL exports to about 1.3 MMb/d, and refined products/petchems to about 470 Mb/d. As we said, in today’s blog we’ll focus on crude oil. (We’ll look at NGLs, refined products and ethylene in an upcoming blog.)

Figure 1. Enterprise Liquid Hydrocarbon Exports. Source: Enterprise

Join Backstage Pass to Read Full Article