When it comes to midstream development in the Northeast, Appalachian natural gas producers have learned by now not to hold their breath. The region is notorious for its staunch environmental opposition to hydrocarbon infrastructure and its propensity for sending gas pipeline projects to the trash pile. Against all odds, however, midstream development in the region has thawed in recent months, in large part spurred by the unlikely advancement of Mountain Valley Pipeline (MVP), the long-embattled project to move up to 2 Bcf/d from the Appalachia gas supply basin to the Transco Corridor, which runs north-south along the Eastern Seaboard. In today’s RBN blog, we take a look at historical flows on Williams’s Transco Pipeline and what they can tell us about how MVP and Transco’s own planned expansions might reshape gas flows along the corridor.

In Part 1, we looked at the latest on MVP and the slew of Transco Corridor expansions that were recently announced. For its part, MVP resumed work on the project in August, shortly after a Supreme Court ruling removed its last major legal hurdle. It has faced construction slowdowns since then, but Equitrans Midstream said during its Q3 earnings call in late October that it expected to finish the bulk of the work by the end of the year, followed by commissioning of the greenfield system in January, and full completion in Q1 2024, with commercial service starting April 1. That’s a delay from the end-of-2023 target set this summer, but for the first time ever, the project is now all but guaranteed to come to fruition.

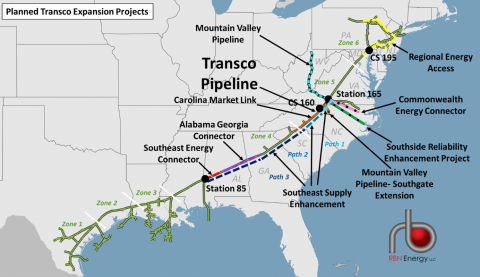

With MVP’s completion on the horizon, the big questions now are when it will be able to flow its full 2 Bcf/d capacity and how much it will end up increasing overall Northeast takeaway capacity. The problem is that the 300-mile MVP (teal-and-black dashed line in Figure 1) will terminate at an interconnect with Transco just inside the Northeast region, as we define it. Specifically, it will have the capacity to move Appalachian gas volumes from northern West Virginia south and east to Transco’s Station 165 in Pittsylvania County, VA, just north of the Virginia-North Carolina border. From there, MVP deliveries into Transco will depend on takeaway capacity from Station 165 in order to access key premium-priced markets within Transco’s zones 4 and 5. That’s because capacity downstream of that point is heavily utilized and so the ability to move additional gas is limited. Additionally, as we discussed in Flyin’ High, Transco is the only major long-haul system supplying gas to the Atlantic corridor, and it is more or less fully contracted with firm commitments.

That’s where the expansion projects come in — to address worsening bottlenecks, particularly as gas plant additions and coal retirements have catapulted gas demand for baseload power generation in the region. As we’ve noted previously, Equitrans is developing MVP Southgate as an extension of the MVP mainline to move supplies to downstream utility customers in North Carolina. However, given the lengthy and costly legal battles that the mainline project faced and Southgate’s own past permitting challenges, the midstreamer has gone back to the drawing board with the project and has yet to sanction it.

At the same time, Williams is planning a number of brownfield expansions to capture the influx of supply from MVP as well as to improve Transco’s access to growing demand centers in the Southeast. We detailed these projects in Part 1, and it’s likely no coincidence that several are designed to provide incremental takeaway from Station 165 (large black dot in Figure 1), including the Carolina Market Link (dashed orange line; 78 MMcf/d by Q1 2024); Southside Reliability Enhancement Project (dashed green-and-black line; 423 MMcf/d by December 2024); Commonwealth Energy Connector (dashed pink-and-black line; 105 MMcf/d by end of 2025); and last but certainly not least, the newly sanctioned Southeast Supply Enhancement expansion (SSE; sequential dashed blue lines; ~1.4 Bcf/d by November 2027).

Figure 1. Planned Transco Expansion Projects. Source: RBN

Join Backstage Pass to Read Full Article