No doubt about it, most of the headline-grabbing oil and gas M&A activity lately has involved large, publicly owned producers gobbling up other good-sized E&Ps, lock, stock and barrel. But there are other ways to increase scale and improve operational efficiency, as evidenced by privately held WildFire Energy’s bolt-on acquisition frenzy in the relatively sleepy northeastern Eagle Ford, aka the East Eagle Ford. In less than three years, with one bolt-on acquisition after another, WildFire — named in anticipation of the company’s aggressive expansion strategy — has morphed from a small player in the often-overlooked area into one of the largest producers there, with a laser focus on maximizing returns to its management and private-equity owners. In today’s RBN blog, we’ll look at the E&P and its rapid rise.

We’ve been tracking M&A in the Eagle Ford for some time now — the number of deals happening there has warranted the attention. A comprehensive list would be too long, but some of the bigger, more notable acquisitions include:

- Devon Energy’s $1.8 billion purchase of Validus Energy, a privately held Eagle Ford producer, which closed in September 2022.

- Marathon Oil’s December 2022 acquisition of Ensign Natural Resources’ Eagle Ford assets for $3 billion (discussed in Come Back Song).

- Spanish energy giant Repsol’s February 2023 purchase of the South Texas acreage and production of Japan’s INPEX Corp. for an undisclosed amount.

- U.K.-based INEOS’s purchase of some of Chesapeake Energy’s South Texas assets for $1.1 billion — a deal that was finalized in May 2023.

- Canadian producer Baytex Energy’s June 2023 acquisition of Eagle Ford pure-play Ranger Oil in a cash-and-stock deal valued at $2.2 billion.

- The $551 million purchase by privately held Ridgemar Energy of Callon Petroleum’s Eagle Ford assets, which closed in July 2023.

- The $22.5 billion plan by ConocoPhillips to acquire Marathon Oil — both companies have a significant presence in the Eagle Ford — which is expected to close in Q4 2024.

Most recently, in We Could Be So Good Together, we delved into Crescent Energy’s plan — announced in mid-May — to acquire SilverBow Resources for $2.1 billion in cash and stock to create what will likely be the third-largest operator in the Eagle Ford, with about 200 Mboe/d of pro forma production. That would put the company well behind the prospectively combined ConocoPhillips and Marathon Oil, whose production in the region would total about 380 Mb/d, and current Eagle Ford leader EOG Resources, with about 300 Mboe/d.

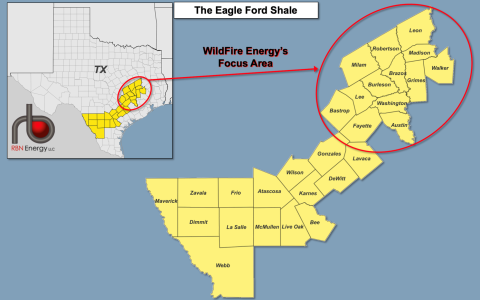

What all those producers and all those deals have in common is that their focus within the broadly defined Eagle Ford (yellow-shaded counties in Figure 1) is almost exclusively on the southwestern 60% of the massive shale basin — the fat swath from the Rio Grande to the counties east of San Antonio (Gonzales, Lavaca and DeWitt). That’s where the vast majority of Eagle Ford wells have been drilled and completed since the Shale Era started in earnest in the early 2010s, and where most of the basin’s production takes place. But the northeastern 40% of the Eagle Ford (area within red ovals) shouldn’t be forgotten — as we’ll get to next, that’s where privately held WildFire Energy has been rapidly accumulating acreage and production.

Figure 1. The Eagle Ford Shale. Source: RBN

Join Backstage Pass to Read Full Article