The price discount for Western Canada’s benchmark heavy crude oil has seen yet another widening in the past few months. Increased pipeline access to the U.S. was believed to be the key to solving this problem in the long term, but more recent fundamental developments surrounding pipeline egress, refinery demand and increasing heavy oil supplies demonstrate that larger discounts can — and do — still happen. This problem could persist for several more months until a better balance is achieved in downstream markets. In today’s RBN blog, we discuss the latest drivers of the wider price discounts for Western Canada’s heavy oil.

The twists and turns in the pricing saga of Western Canada’s heavy crude oil marker, Western Canadian Select (WCS), are seemingly endless. Used as the benchmark for heavy crude pricing, its value at the price hub of Hardisty, AB, is determined as a discount to the price of light crude oil benchmark WTI at Cushing, OK. The magnitude of that discount is a very important determinant in the price netback realized by heavy oil producers, which account for about 80% of all the crude produced in Western Canada. With that kind of weighting, the price of WCS and its discount is a very big deal.

The fact that heavy, higher-sulfur oil is priced at a discount to light sweet crude is not surprising, especially for WCS and other related heavy oil streams produced in Western Canada. Heavy oil requires more processing at refineries to be turned into useful end-use products such as gasoline and diesel, meaning higher costs; it has to be transported very long distances to reach refineries in Eastern Canada, the Midwest, and the Gulf Coast, meaning higher costs; and there can be choke points in the transportation network of pipelines where too much crude oil supply is competing for too little pipeline space. In that situation, the discounting can become more extreme at certain locations as producers engage in barrel-on-barrel competition by offering a wider and wider discount (i.e., lower absolute price) to ensure their supply gets into the pipeline to downstream refiners ahead of a competitor’s supply. When this combination of upstream supply, downstream refinery demand and pipeline networks is well synchronized, the price discount for WCS should more or less reflect the combined cost of transportation and refinery processing, with the bulk of that coming from the cost of pipeline transportation.

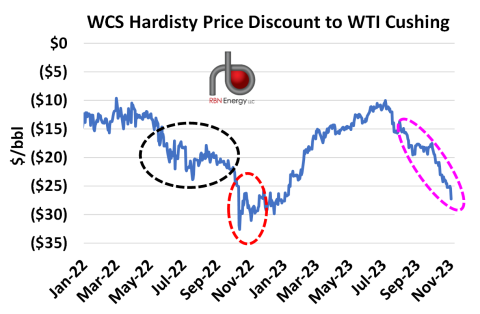

As you might expect, the motivation for today’s blog — and song title — is that in the past couple of months the discounting of WCS seems to harken back to past same ol’ situation(s) of greater price discounting, recently reaching levels as low as US$27/bbl under WTI (pink dashed oval in Figure 1) at the end of October and well below the more market-optimal discount that lies in the $10-$15/bbl range. The rough math means that Western Canada’s heavy oil producers are getting $12/bbl less for their heavy crude oil than they were just a few months ago, and at a time when benchmark light crude oil prices like WTI have remained elevated in a global market shaped by producer-driven supply constraints and geopolitical upheavals.

Figure 1. WCS Discount to WTI. Source: Bloomberg

Join Backstage Pass to Read Full Article