Huge fees may be coming to ships built in China each time they arrive at a U.S. port. During a hearing in Washington on Monday, the Office of the U.S. Trade Representative (USTR) heard comments on its January 2025 study that laid out China’s strategy to achieve dominance in the global maritime, logistics, and shipbuilding sectors — a strategy that has worked spectacularly. Since 1999, China’s share of the global shipbuilding market has soared from 5% to 50%. The USTR argues that China’s growing control over the maritime sector poses serious economic and national security risks to the U.S., making immediate action necessary. Proposed measures include imposing port fees from $1 million to $1.5 million per port entry. If implemented, the fees would substantially increase costs for exports and imports using Chinese ships. That could have incredibly disruptive impacts on most oceangoing transport, and energy products are no exception — unless they get an exception! In today’s RBN blog, we explore the background of the USTR’s China port-fee proposal and what it could mean for global energy logistics.

The potential action against Chinese shipbuilding originated with the Biden administration and — unusual in today’s political climate — has been adopted and carried forward by the Trump administration. Here’s the backstory. In early 2024, the United Steelworkers, the International Brotherhood of Electrical Workers (IBEW), the International Brotherhood of Boilermakers and Ship Builders (IBB) the International Association of Machinists and Aerospace Workers (IAM), and the Maritime Trades Department (MTD) of the AFL–CIO requested that the USTR launch an investigation under Section 301 of the Trade Act of 1974, which allows the U.S. to penalize foreign countries that engage in acts that are “unjustifiable,” “unreasonable,” or burden U.S. commerce. Biden’s Trade Representative, Katherine Tai, launched the probe in April 2024.

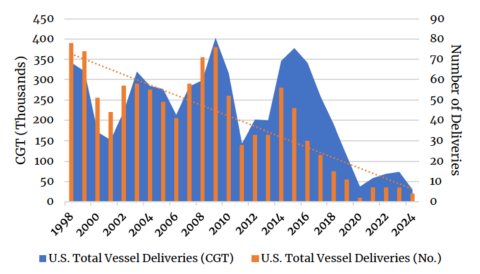

On January 16 — four days before President Trump’s inauguration — the Trade Representative’s office issued the “Report on China’s Targeting of the Maritime, Logistics and Shipbuilding Sectors for Dominance.” The 170-page report is an exhaustive analysis of China’s dominance over shipping and documents how the U.S. has ceded almost all shipbuilding to other countries. As shown in Figure 1 below, the U.S. commercial shipbuilding sector has fallen to less than five deep-draft vessels a year from 78 in 2009 (orange bars and right axis), while China now builds 1,700 ships annually. U.S. compensated gross tonnage (CGT; blue area and left axis) has dropped from 400,000 to 25,000 annually. These numbers include everything from cruise ships and dry bulk to container carriers and oil tankers.

U.S. Vessel Deliveries, 1998-2024

Figure 1. U.S. Vessel Deliveries, 1998-2024. Source: Office of the U.S. Trade Representative

Join Backstage Pass to Read Full Article