The 35-year dream of widening the Corpus Christi Ship Channel and deepening it to 54 feet from the old 47 feet is at long last a reality. The $625 million project also has spurred marine-terminal owners in Corpus Christi and Ingleside to undertake — or at least consider — major dock and dredging projects that would enable them to make full use of the deeper 30-mile channel. In today’s RBN blog, we discuss the newly completed channel-dredging project, related terminal improvements, and what they all mean for crude oil exporting economics in Corpus Christi.

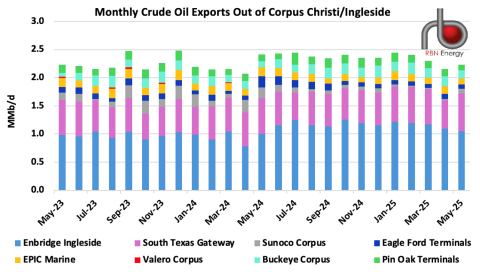

U.S. crude oil exports have been sliding the past few months, in part due to tariff-related upheavals in U.S. and international energy markets. According to RBN’s weekly Crude Voyager report, an average of 3.45 MMb/d were exported from Texas and Louisiana terminals in May, down from 3.87 MMb/d in January and the lowest monthly average since January 2023. Corpus Christi, the #1 port for sending out crude since 2020, has experienced a smaller (but still noteworthy) decline in crude export volumes; its May exports averaged 2.23 MMb/d (stacked bar to far right in Figure 1 below), down from 2.45 MMb/d in January and an average of 2.31 MMb/d in full-year 2024.

Figure 1. Monthly Crude Oil Exports Out of Corpus Christi/Ingleside. Source: Crude Voyager

As we’ve discussed in several blogs, there are at least a couple of reasons why Corpus Christi/Ingleside, with a 61% share of Gulf Coast crude oil exports in the first five months of 2025, has maintained a strong lead over the Houston area (with a 31% share), Beaumont/Nederland (6%) and Louisiana (2%). One is the ability of two Ingleside marine terminals — Enbridge Ingleside Energy Center (EIEC; light-blue bar sections in Figure 1 above) and Gibson Energy’s South Texas Gateway (STG; purple bar sections) — to partially load 2-MMbbl Very Large Crude Carriers (VLCCs) at their docks before sending them out to the deeper waters of the Gulf for topping off via reverse lightering. (VLCCs are the transporters of choice for many shippers moving crude from the Gulf Coast to Asia and Europe because of the lower per-barrel cost.)

Join Backstage Pass to Read Full Article