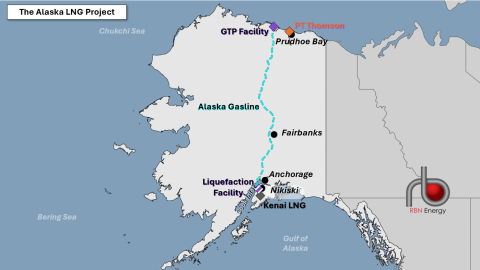

The Trump administration is trying to breathe new life into the long-dormant Alaska LNG project, talking up its strengths and encouraging potential Asian customers and investors to consider it. But the project, a multibillion-dollar plan to pipe natural gas from Alaska’s North Slope to Anchorage and Cook Inlet for liquefaction and export, faces huge financial and administrative hurdles, plus the challenges of building it in Alaska’s rugged terrain and often-harsh climate. In today’s RBN blog, we’ll examine Alaska LNG’s competitive position and whether its reduced shipping costs, coupled with federal support, might be sufficient to outweigh the construction costs and other major obstacles the project faces.

As we noted in Part 1 of this miniseries, President Trump’s backing has renewed interest in the long-dormant Alaska LNG project, which would enable exports of up to 20 million tons per annum (MMtpa; ~2.6 Bcf/d) and help meet local demand for gas around Cook Inlet. The concept of exporting LNG derived from Prudhoe Bay gas reserves has been a longstanding objective of the Alaska state legislature, which highly supports the project. But the effort has long been viewed with significant skepticism, given the inherent challenges of building a massive pipeline several hundred miles across the state’s mountainous midsection. Estimates put a final price tag at about $44 billion, with construction taking at least several years.

Developing and cementing the relationships needed to build any large-scale project can be challenging. We explained in our previous blog that Alaska LNG has several complicating factors to address, including securing the necessary volumes of feedgas from regional producers, the commercial structure of the pipeline, and the need to line up commitments with potential partners and offtakers. Today, we focus on the critical issues of financing the pipeline and LNG plant and its uncertain commercial prospects in a market already experiencing a glut of new U.S.-based projects looking for customers. (For a weekly analysis of North American LNG export activity and infrastructure developments, see our LNG Voyager report.)

Figure 1. The Alaska LNG Project. Source: RBN

Join Backstage Pass to Read Full Article