Rising demand for natural gas storage in the Gulf Coast region has spurred growing interest and investment. A number of midstream companies have been making moves, either by expanding their existing storage facilities in Texas, Louisiana, Mississippi and Alabama or entering the space with acquisitions or plans for greenfield projects. As a result, more than 150 Bcf of new gas storage space is in various stages of development. In today’s RBN blog, we discuss highlights from our new Drill Down Report on Gulf Coast gas storage.

Storage has long been a critically important balancing mechanism in the Lower 48 natural gas market. After languishing for much of the Shale Era, storage values have been coming out of the doldrums the past couple of years. The key driver behind this change is that, unlike in the old days, when the storage market was driven primarily by the intrinsic value of capacity — i.e., the need to sock away gas in the lower-demand summer months for use in the peak winter months — the value of storage is being driven mostly by extrinsic economics — i.e., how flexible and responsive capacity allows market participants to manage supply and demand during short-term market swings.

This is especially true in the Gulf Coast region, where a combination of factors — rising gas production, increasingly undulating demand for gas (tied in part to the ups and downs of wind and solar power), frequent extreme weather events, new LNG export capacity, and plans for tens of thousands of megawatts (MW) of new gas-fired power generation — have been increasing the value of gas storage or, more specifically, the merit of quickly injecting and withdrawing gas to respond to market swings. As a result, interest in developing gas storage projects with high deliverability rates and cyclability has taken off, with billions of cubic feet of new storage capacity already coming online and a lot more in the works.

There’s a caveat, though: Against the backdrop of storage markets that were previously overbuilt, while gas storage capacity is increasingly valued for its role in providing volume assurance and the opportunities created by high deliverability, that doesn’t necessarily mean storage values will be high enough to support the large-scale buildout of new facilities. Instead, the development of new storage capacity is likely to be very targeted — it will happen only where it clearly makes economic sense.

We’ve been exploring the Gulf Coast gas storage market in recent months and discussing who owns what — and who’s planning what — in this space. The players generally fall into one of three categories: (1) legacy market participants with expansion plans, (2) midstreamers acquiring storage and planning more, and (3) newer, storage-focused companies developing greenfield projects. (Admittedly, the lines between the categories are a little blurry.)

Legacy players

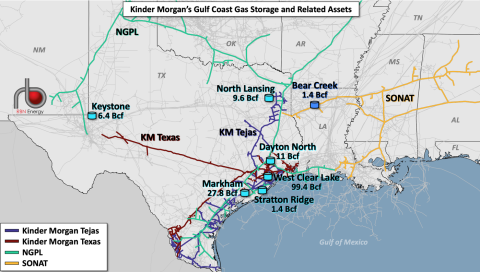

Kinder Morgan is a major player in gas storage, not just along the Gulf Coast but nationally, with full or partial ownership in more than 700 Bcf of storage capacity, including more than 155 Bcf (light-blue tank icons in Figure 1 below) along or near the midstream giant’s Texas and Tejas intrastate pipeline systems (brown and purple lines): 99.4 Bcf of capacity at West Clear Lake, 27.8 Bcf of capacity at Kinder’s recently expanded Markham Storage facility in Matagorda County, TX (more on that in a moment), and another 20 Bcf or so at several other sites, including 1.4 Bcf of storage (Bear Creek) in northern Louisiana along the Southern Natural Gas (SONAT) system (medium-blue tank icon and yellow lines, respectively), in which it holds a 50% stake.

Figure 1. Kinder Morgan Gulf Coast Gas Storage and Related Assets. Source: RBN

Join Backstage Pass to Read Full Article