In an industry such as oil and gas that is beset with more uncertainty than usual of late due to geopolitical upsets, bubbling trade wars and a recent plunge in crude oil prices, being a larger company with the resources to survive the turbulent times — and thrive when the sailing is smoother — is more important than ever. For Western Canada’s energy sector, this has meant companies getting bigger through mergers. In today’s RBN blog, we discuss the planned combination of Whitecap Resources and Veren, one of the largest deals to emerge in the region in recent memory, as well as several other recent transactions that have been part of the consolidation wave.

Western Canada’s oil and gas producers continue to be spellbound by the unconventional, gas-prone Montney formation that straddles the provinces of Alberta and British Columbia (BC) and the liquids-rich Duvernay shale formation that lies within Alberta. The Montney has proven itself to be one of the premier gas-producing formations in the world with huge proven reserves, low finding costs and significant production rates that have attracted interest from near and far and helped drive the development of multiple LNG export projects along Canada’s West Coast. As for the Duvernay, its liquids-rich nature is yielding rising volumes of both light crude oil and condensate/pentanes plus (referred to in the U.S. as field condensate and natural gasoline), with the latter highly prized for immediate demand in Alberta’s oil sands, where it is used as diluent that allows the heavy, viscous bitumen to be shipped in pipelines. It also doesn’t hurt that condensate prices in the Alberta market often trade at parity or a premium to WTI.

(As the energy landscape continues to evolve, understanding the forces shaping crude, natural gas and NGL markets has never been more critical. RBN’s Martin King will examine those themes during a webcast titled Livin’ On The Edge at 2:30 pm Central Time on Thursday, April 24. That will also serve as a preview of RBN’s School of Energy Canada, set for August 26-27 in Calgary. Click on the links to learn more; additional details at the bottom of today’s blog.)

All those positive vibes, though, have been tempered the past couple of years — and especially the past couple of months — by unsettling upheavals, the most obvious being a still-simmering trade war between the U.S. and Canada. One way to prepare for whatever happens next is to team up and gain scale, and that’s just what Whitecap Resources Inc. and Veren Inc. — two midsized oil and gas producers in Western Canada — plan to do via an all-stock merger valued at as much as C$15 billion (~US$10.7 billion). The two companies’ diverse assets in the Alberta portion of the Montney and Duvernay (and other parts of Western Canada) will be combined by May to create a larger entity they say will enable them to compete in terms of production, access to capital, cost-reduction potential, and land holdings for future drilling prospects.

Although there has been some debate as to the total dollar value of the transaction being closer to C$8.5 billion, as the deal is effectively an acquisition of Veren by Whitecap, it is one of the largest corporate deals in the Canadian oil and gas sector in recent years. In February 2021, ARC Resources acquired fellow Montney producer Seven Generations Energy in an C$8.1 billion transaction, and in October 2024 Canadian Natural Resources Limited (CNRL) purchased a 70% working interest in Duvernay and certain oil sands assets from Chevron for C$8.9 billion.

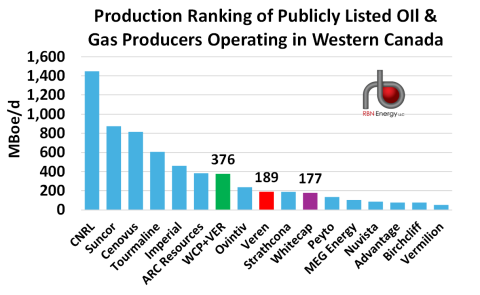

Pre-merger, Veren and Whitecap are roughly equivalent producers, with Q4 2024 production of 189 Mboe/d and 177 Mboe/d, respectively (red and purple bars, respectively, in Figure 1 below). The combined entity, which will proceed under the Whitecap name, will become the seventh-largest publicly listed oil and gas producer in Western Canada (WCP+VER; green bar), with production of 376 Mboe/d (slightly behind ARC Resources), which represented roughly 5% of Western Canada’s 8.1 MMboe/d of total oil and gas output in Q4 2024. (The 15 companies that we have compiled in our ranking accounted for ~73% of all the oil and gas production in Western Canada at the end of 2024. Note that we have excluded companies operating in Western Canada that have their corporate headquarters overseas, such as Shell and Petronas, both sizable players in the gas-focused Montney.)

Figure 1. Production Ranking of Publicly Listed Oil and Gas Producers Operating in Western Canada.

Sources: RBN, Company Reports

Join Backstage Pass to Read Full Article