The US natural gas market is in a precarious state. CME/NYMEX futures contract prices have been settling at historic lows for this time of year. Producer returns are dismal in most shale basins. Yet production volumes remain robust, and the supply/demand balance is way out of whack. The surplus in storage is soaring at more than 500 Bcf above last year and more than 400 Bcf above the 5-year average. It’s clear something has to give. But how will the imbalance get resolved and how will the resolution impact the price of natural gas? To help you navigate market signals and stay ahead of upcoming turning points, today we introduce our new daily NATGAS Billboard: Natural Gas Outlook report featuring storage and price forecasts plus a daily market outlook.

Before we get to our current market outlook, first a bit of background on the new report. We have teamed with our good friends at Criterion Research, including ace gas market forecaster Kyle Cooper to develop NATGAS Billboard – a daily morning update on the U.S. natural gas market. Each morning, we will go through the same exercise that dozens of in-house analysts perform for their trading shops. Taking the latest iterations of the raw fundamental data, (including weather forecasts, pipeline flow data, storage facility postings, weekly electricity demand data, CME/NYMEX price action and the weekly EIA inventory data), we will mesh it all together in our proprietary models and come up with our best interpretation of what it all means for storage and ultimately price. We will then share the answers with you in a clean, concise report. As new data comes in each day, we’ll continue to revise our outlook.

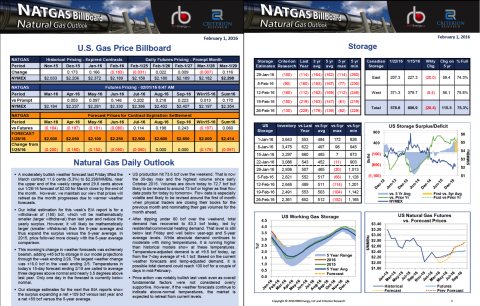

First and foremost, NATGAS Billboard distills all our analysis down into a number – price. Figure 1 below shows the first two pages of the report. The flagship feature is our snapshot outlook on evolving forward natural gas prices at the top of Page 1, starting with the prompt month futures contract going out seven forward contract months and, on a seasonal average basis through the prompt season, currently summer 2016. We call this a “forecast”, and in a way that’s what it is. The numbers reflect the price level where we see the monthly CME/NYMEX Henry Hub gas futures settling at expiration – based on the data in hand at the moment we kick the report out. But of course, these numbers won’t really tell you where prices will end up. (If we knew that, you better believe we would keep it to ourselves.) Rather, the forecast reflects our interpretation of the fundamentals (the latest data and model runs) at a point in time, and what they imply about price direction. The report also contains a daily written summary of our outlook (bottom of Page 1), our 5-week EIA storage report estimates (top left of Page 2) and supporting data tables and graphs that highlight the fundamentals and rationale behind our price forecast.

Figure 1 (Click to Enlarge)

We refresh our outlook daily because the gas market gets bounced around each day as new data becomes available, especially weather data. In the short-term weather impacts demand, storage activity and price expectations. Other dynamic data points include daily pipeline flows, weekly electricity demand for gas generation (power burn) and inventory postings by key storage facilities that provide early signals of near-term storage and price direction as well as changes in underlying trends. Today’s market conditions make price especially sensitive to daily fluctuations in weather and the supply/demand balance. This continually updated daily view is critical to our longer-term market outlook.

Join Backstage Pass to Read Full Article