U.S. fuel supplier Sunoco announced in May that it has inked a US$9.1-billion agreement to buy Canada-based Parkland Corp., a move that would create the Americas’ largest independent fuel distributor. Sunoco would gain control of Parkland’s fleet of fueling stations and its valuable Burnaby refinery near Vancouver, BC. The deal is supported by Parkland’s largest shareholder and is slated to be voted on June 24. In today’s RBN blog, we’ll discuss this deal and what it means for Canada’s only West Coast refiner.

Under terms of the proposed transaction, whose total value includes debt, Parkland shareholders will receive C$19.80 in cash and 0.295 shares in a new, publicly traded entity called SUNCorp. Parkland shareholders can also choose to receive C$44.00 in cash or 0.536 Sunoco units per share. The deal includes a C$2.65 billion bridge loan for Sunoco.

The planned acquisition was approved unanimously by Parkland’s board of directors in early May and is supported by Parkland’s largest shareholder, Simpson Oil, which believes it provides the potential for enhanced operations and opportunities under Sunoco’s experienced management. Dallas-based Sunoco, a master limited partnership (MLP) whose general partner is controlled by Energy Transfer, first expressed interest in Parkland in 2023 and made an offer, but it was turned down, according to published reports.

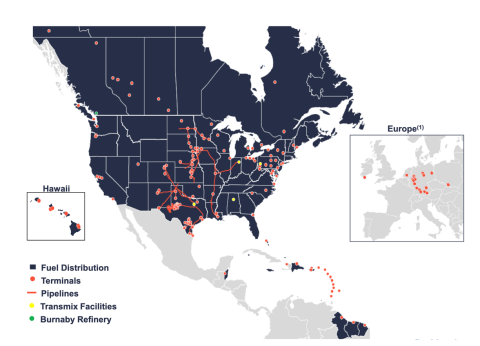

Combined Assets of Sunoco and Parkland

Figure 1. Combined Assets of Sunoco and Parkland. Source: Sunoco

Join Backstage Pass to Read Full Article