RBN blog pages are replete with discussions of the Shale–Rail revolution. We’ve shown how rail has become a formidable competitor to pipeline transportation. Twice as much crude oil moves by rail out of the Bakken versus pipe. Almost 100 new rail terminals will be built during 2012-13. But that’s not the only impact that shale is having. Most of the vast quantities of materials that support shale drilling arrive by rail. Among these are proppants (sand, ceramics), pipe, lubricating chemicals, and water. Today we examine the other end of the shale-rail revolution – the inbound material supply chain.

As shown in the table below, a typical 30 stage frac well requires tons of materials and transportation (see Tales of the Tight Sands Laterals for an explanation of hydraulic fracturing). It takes 40 rail cars of proppants transported to a transloading facility, then another 160 trucks to move that proppant to the well site. Five more rail cars linked to 20 trucks get the drill pipe to the site, with another 3-5 cars and 20 trucks moving the necessary chemicals. Over 1,000 trucks can be needed handle the inbound water while 500 trucks carry away wastewater. Add it all up and its about 50 rail cars and 1,200 trucks involved to drill just one well.

The demand for these materials continues to increase. In the proppants market alone, demand is expected to grow up to 75% over the next five years. New technologies have enabled the increase in lateral drilling length. “Monster wells” with expanded staging, have driven the demand for proppants in particular ever higher. These larger wells need ever more materials and the drilling engineers keep pushing the envelope.

Source:PLG (Click to Enlarge)

Dirt Cheap

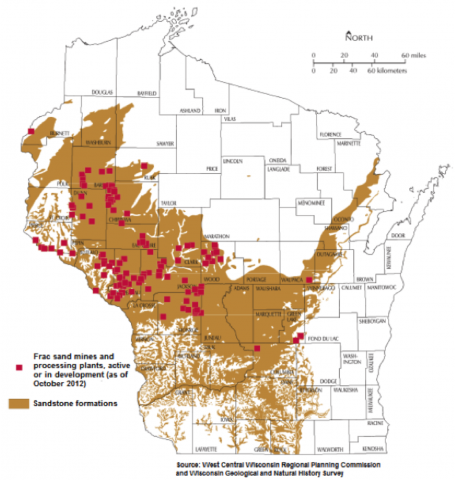

Yet as the market demand for proppants and other materials increases, the supply side of the equation has already begun to outpace it. Take for example, frac sand. You can’t just use any ole’ sand in the hydraulic fracturing process. It is special silica sand from that most exotic of sandy locations – Wisconsin. Wisconsin? You read right. Wisconsin has seen an industrial mining boom the last several years, dubbed the “sand rush” due to the roundness, hardness and consistent quality of their sand, making that state the center of the frac sand supply network. Nearly 80% of the proppants used in a shale well is this natural, silica sand with the other 20% coming from different combinations of resin-coated sand and ceramic (manufactured) sand.

Sand mining was the bottleneck in the shale supply chain during the 2011 timeframe, however, numerous mines have come on line to dramatically change that situation. From June 2011 to June 2012, there were 60 mine and processing centers proposed in Wisconsin during the sand rush days. Since then, only 4 new locations have been proposed. This boom to bust cycle has put the industry in a serious overcapacity situation resulting in free-falling sand prices. The spot market price for processed sand in Wisconsin has dropped from approximately $100/ton in early 2012 to around $40/ton today, which is “dirt cheap”.

Click to Enlarge

It’s About the Transportation Costs

Frac sand may be dirt cheap, but not so the cost of getting that sand to the drill site. As shown in the graphic below, the cost of the sand itself is only 42% of the total delivered cost. The other 58% is composed of rail transportation costs, transload and trucking costs – all logistics. Those costs, especially the rail costs, are headed up.

Optimal Cost Ratios Using Unit Trains From WI to TX

Source: PLG (Click to Enlarge)

The shipping of proppants by rail has seen a price increase in just the past 18 months of 10-14% in different corridors, even as the total volume of sand cars has moved ahead of the onshore rig count due to the increasing amounts of sand used per well. (As shown below, sand carloads exceeded 100,000 per quarter last year.) These cost increases have been mitigated by the larger shippers who can take advantage of unit train moves and whose demand allows for volume commitments over the long term. Unit trains are normally 100 to 130 cars for frac sand. These high-volume commitments have dictated the design and development of new transloading facilities as well, with the ability to handle unit trains being a key competitive factor for transloaders. Many of these transloading facilities have become more integrated, with the same company handling both transloading activities and trucking. The cost advantage of utilizing unit trains instead of manifest service (less than 100 car, partial load trains) can be in the range of 15 to 30% on a per ton basis depending on the route, so it is all about volume, volume, volume.

Join Backstage Pass to Read Full Article