The transition of U.S. E&Ps to capital discipline has led to historic shareholder returns and won back legions of investors who had virtually abandoned the industry until a few years ago. But while it might be tempting to conclude producers must finally have their financial houses in good order, a lot of us have witnessed a few boom-and-bust cycles in our time and remain hypervigilant for any signs of financial instability, especially considering that commodity prices could weaken at any time. In today’s RBN blog, we analyze the impact of lower price realizations and capital allocation decisions on the balance sheets of the major U.S. independent oil and gas producers.

As we reviewed in If You’ve Got the Money, Honey, lower price realizations and higher capital spending reduced free cash flow for the 44 E&Ps we cover by about 50% to $45.6 billion in 2023. Understandably, producers weren’t able to sustain the record shareholder returns of 2022 as share repurchases and dividends fell by 43% and 25%, respectively. However, buybacks and dividends were still significantly higher than any year prior to 2022. To partially fund these returns and help finance a record wave of E&P M&A activity, our companies added about $8.5 billion in net debt. The question is, what impact did all this have on their balance sheets?

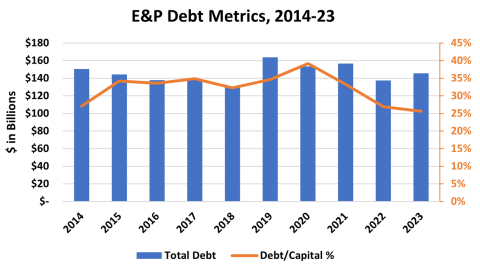

The answer is E&P credit metrics held remarkably steady in 2023 and remained historically strong. As shown in Figure 1 below, the debt-to-capital ratio (orange line and right axis) for the companies we cover actually dipped to a decade-best 26% in 2023, down slightly from 27% in 2022, despite the increase in total debt (right-most blue bar and left axis) as investor support for the industry stayed robust. The debt-to-capital ratio had exceeded 30% in every year from 2015 to 2021, peaking at 40% in the pandemic-influenced 2020.

Figure 1. E&P Debt Metrics, 2014-23.

Source: Oil & Gas Financial Analytics, LLC

Join Backstage Pass to Read Full Article