As we’ve frequently chronicled, 2022 was a golden year for U.S. exploration and production (E&P) companies and their investors, as soaring commodity prices triggered record cash generation to fund the highest levels of shareholder returns of any American industry. But Camelot didn’t last forever, and the twin impacts of lower hydrocarbon prices and rising inflation inevitably eroded cash flows in 2023. The good news is that these fiscally disciplined producers still recorded the second-best results of the last decade to fund historically strong shareholder returns. In today’s RBN blog, we detail the 2023 cash allocation of the 41 major U.S. E&Ps that we cover.

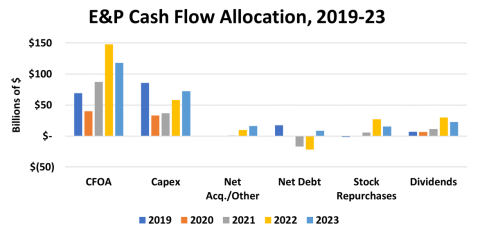

As we recently reviewed in our blog on 2023 earnings, Good Enough, realized prices for the 41 E&Ps declined by one-third last year but cash flows from operating activities (CFOA; far-left column group in Figure 1 below) declined by just 20.4% to $117.9 billion (light blue columns). Largely driven by strong post-pandemic inflation, capital expenditures grew 24% to $72.3 billion. Lower inflows and higher investment squeezed free cash flow (FCF; not shown in graph) by about 50% to $45.6 billion. Understandably, producers were unable to sustain the record shareholder returns of 2022, so stock repurchases and dividends were reduced by 43% and 25%, respectively, to $15.3 billion and $22.5 billion. Nevertheless, dividends and share repurchases were significantly higher than any year prior to 2022. Dividends were still twice the amount and share repurchases were nearly three times the level posted in 2021.

Figure 1. E&P Cash Allocation, 2019-23. Source: Oil & Gas Financial Analytics, LLC

Join Backstage Pass to Read Full Article