As the global crude oil market continuously evolves, so do the tools that traders, refiners and producers rely on to navigate its complexities. Among these tools, futures contracts play a pivotal role, allowing market participants to manage risk and ensure liquidity. In today’s RBN blog, we’ll explore what sets apart two major futures contracts for West Texas Intermediate (WTI) crude oil, focusing on the differences in location, connectivity and quality — and how those distinctions define their roles in the market.

In the first blog of this series, Room at the Top, we looked at the history of WTI futures contracts. Today we’ll dive into the differences between the Chicago Mercantile Exchange’s (CME) WTI Light Sweet Crude Oil futures contract (contract symbol: CL) and the Intercontinental Exchange’s (ICE) West Texas American Gulf Coast futures contract (contract symbol: HOU).

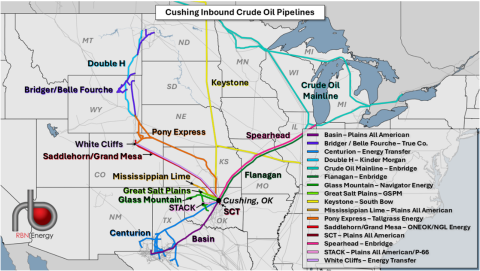

Let’s start with the original WTI crude oil futures contract: CL. The delivery point for CME’s New York Mercantile Exchange (NYMEX) futures contract for WTI is in the middle of the country — Cushing, OK (black dot in Figure 1 below). (Note: Chicago-based CME Group acquired NYMEX Holdings in 2008 for just over $11 billion.) The Cushing complex, which plays an important role in both the physical and financial sides of the crude market (more on that in a moment), is home to approximately 94 MMbbl of storage but encompasses more than just an assemblage of aboveground tanks for parking crude oil. Its effectiveness as a hub depends on the ability of the oil to move in, around, and out. Today, 19 major pipeline systems with a combined capacity of more than 4 MMb/d flow into Cushing (see Figure 1 below), delivering crude from a long list of production areas, including Western Canada, the Bakken, the Powder River Basin, the Denver-Julesburg (DJ) Basin, SCOOP/STACK and the Permian. There are also 12 pipelines flowing out of Cushing, totaling more than 3 MMb/d. Connectivity within the Cushing complex is flexible and very robust (directly or indirectly connecting all Cushing operators to each other within the hub area) and its network helps connect supply areas to refinery demand regions.

Figure 1. Cushing Inbound Crude Oil Pipelines. Source: RBN

While the Gulf Coast’s crude oil storage is spread along hundreds of miles of shoreline, all of Cushing’s storage is highly concentrated within an area of less than 10 square miles, functioning as a single, integrated trading hub, which makes it easier to move barrels between terminals at a lower cost. Further, with access to nearly 20 different grades of crude oil, Cushing offers all sorts of blending opportunities.

Join Backstage Pass to Read Full Article