Ethane has been in the doghouse for years since the shale gas boom kicked in, with production greatly exceeding demand and hundreds of thousands of barrels per day being “rejected” into the natural gas stream – owing to the fact that netbacks for liquid ethane are lower than pipeline natural gas. One way to understand that relationship is to track the price ratio of ethane at Mont Belvieu, TX to natural gas at Henry Hub, compared on a BTU basis. That ratio of ethane-to-gas languished at 95% between Q1 2014 through the summer of this year, and in November 2014 dipped to only 61%. That means that the BTU value of ethane at that point was only 61% of natural gas. Ethane that cheap is an awesome value for steam crackers using the feedstock to produce ethylene and other petrochemicals. But a couple of months ago (September 2015), the price of ethane started to ramp up relative to gas, blasting through 140% in late October. Is that bad news for future ethane prices? What does that portend for ethane once all the new steam crackers being built come online and overseas exports – also coming soon -- ramp up. Today we look at the recent rebound in the ratio of ethane to natural gas and consider whether this is a signal that ethane is out of the doghouse.

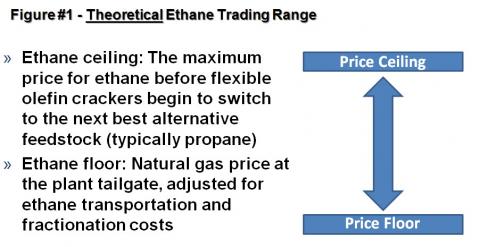

Before jumping into the latest ethane market developments, let’s first do a quick review of why the ethane-to-gas ratio is worth watching and the math for converting the price of ethane to gas and vice versa. U.S. ethane only has two uses; as a petrochemical feedstock for producing ethylene or as a fuel when sold with the natural gas stream. These two uses then set a theoretical price trading range for ethane. Figure #1 below depicts this theoretical trading range. The theoretical price floor is what we are tracking with the Mont Belvieu ethane to Henry Hub natural gas ratio which applies in an oversupplied market where any ethane beyond petrochemical demand is left in the natural gas stream (a.k.a., rejected) and sold for its BTU value as pipeline natural gas. A one-to-one Mont Belvieu ethane to Henry Hub natural gas ratio or 100% indicates that ethane is worth no more (or no less) than natural gas before factoring in transportation and fractionation costs to produce ethane (and a lot less once those costs are factored in). For more on ethane rejection economics see The Ethane Asylum: Big Time Ethane Rejection In The Shale Gas World. The price ceiling carries more weight in a tight market where demand is pulling ethane into the petrochemical sector and the price of ethane is able to rise to the point just before steam crackers switch to a more competitive feedstock (like for example, propane or normal butane). In markets where all light NGL feedstocks (ethane, propane, and normal butane) are oversupplied, as we are today, the relative competitiveness of the feedstocks also keeps downward pressure on ethane prices, which we’ll discuss later in this blog.

Source: RBN; (Click to Enlarge)

When the Mont Belvieu ethane to Henry Hub natural gas ratio begins to rise as it has over the past several months it could be an indication that we are moving away from the price floor and that the supply/demand balance is tightening up. Over the past few years with ethane in significant oversupply and trading at rock bottom prices, many projects -- both petrochemical plants and export projects-- have been planned, developed and are now under construction or already operational, and are expected to soak up the excess supply. For more on these projects and projected supply demand balances see Beyond Hypothermia - Extreme Petrochemical Feedstock Margin Declines For Steam Crackers and It’s Not Supposed To Be That Way – Developing NGL Supply/Demand And Price Scenarios.

Join Backstage Pass to Read Full Article