The world consumes about 100 MMb/d of liquid fuels, which are critically important to every segment of the global economy and to nearly every aspect of our daily lives. The size and scope of this market means it’s impacted by all kinds of short-term forces — economic ups and downs, geopolitics, domestic developments and major weather events, just to name a few — some of which are difficult, if not impossible, to foresee. But while these events can sometimes come out of nowhere, there are some long-term forces on the horizon that will shape markets in the decades to come, even if the magnitude of these changes might be up for debate. One is a move to prioritize alternative fuel sources rather than crude oil, but a meaningful shift won’t happen as quickly as many forecasts would indicate — and that has big implications for liquid fuel demand and the outlook for U.S. refiners. In today’s RBN blog, we discuss these issues and other highlights from the recent webcast by RBN’s Refined Fuels Analytics (RFA) practice on their newly released update to the Future of Fuels report.

It's no secret that energy markets can sometimes turn on a dime. That’s been especially true since the beginning of the 2020s. In the past three-plus years, a variety of events — including a pandemic-induced market crash, followed by a price spike sparked by the largest land war in Europe since World War II — has sometimes left us feeling like we’re on an old wooden roller-coaster ride, complete with all the gut-wrenching ups and downs and twists and turns that leave your brain rattling around in your head. Other rides are smoother and slower — like the small-scale railroad that circles an amusement park — and you can generally anticipate what’s coming down the track, similar to the long-term move toward alternative fuels, which has largely been driven by government policy. In the U.S., those policies include higher fuel-efficiency requirements for new cars and trucks and expanded tax credits to speed the adoption of electric vehicles (EVs). It’s a commonly repeated refrain that peak global oil demand is on the horizon, perhaps even in the next decade or so, but RFA continues to believe that the horizon is farther away than the consensus, due largely to several economic, technical and market-related hurdles.

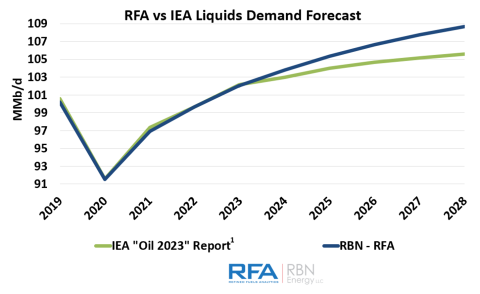

Figure 1. RFA and IEA Liquids Demand Forecast. Sources: RFA, IEA

Join Backstage Pass to Read Full Article