The Gulf Coast is the engine of U.S. energy markets and its fiercely competitive. Over the past decade, monumental growth of crude oil and NGL production, predominantly from the Permian Basin, has led to a surge in exports, with more than 90% of these liquids departing from marine terminals along the Texas and Louisiana coasts. To facilitate that growth, the region has also experienced a tremendous buildout of gathering systems, pipelines, processing facilities, and especially export docks. Major Gulf Coast market regions like Corpus Christi, Houston, Beaumont, Lake Charles and Baton Rouge all have unique advantages and disadvantages. And the companies that operate in those regions have strategic motivations for where they would like to see new volumes go. As the Gulf Coast energy sector presses on to a new horizon, competition for market share among major players is intense, impacting producers, midstream operators, downstream consumers and exporters alike. That was the focus of our recent NACON: PADD 3 conference and it’s the subject of today’s RBN blog.

Warning: Today’s blog includes a couple of blatant plugs for a newly available replay of our recent conference in Houston.

Let’s start with a quick reminder of how dominant a position the Gulf Coast — PADD 3 — holds in the overall U.S. energy picture. The reason PADD 3 gets so much attention today is because it accounts for the lion’s share of domestic crude oil and NGL production and nearly half of U.S. natural gas production. It’s also the destination market for the vast majority of those commodities from around the country. That’s because PADD 3 is home to a titanic energy complex of refineries, fractionators and petrochemical facilities that transform the crude and NGLs into more valuable products, with a comprehensive network of pipelines, storage and export terminals built to serve those markets.

When you hear PADD 3 described as the engine that’s driving the U.S. energy industry, here’s what we mean:

- PADD 3 is home to more than half of domestic refining capacity, with a host of world-class, complex refineries. There’s about 10 MMb/d of atmospheric distillation capacity in the region. As a comparison, PADD 2 (Midwest) comes in a distant second at 4.2 MMb/d.

- For the fractionation of mixed NGLs (Y-grade) into its components, the dominance in PADD 3 is even more pronounced, with three-quarters of domestic fractionation capacity (6.3 MMb/d) located in the region — most of that in Mont Belvieu, TX.

- And with the region awash in petrochemical feedstocks, it should come as no surprise that PADD 3 dominates in petchem production, too. It’s home to more than 90% of domestic steam cracker capacity.

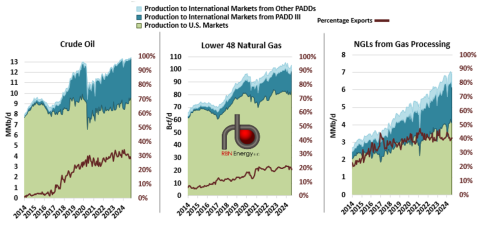

Then there’s the export market. It’s no secret that as domestic supplies of crude oil, natural gas and NGLs have expanded, an increasing proportion has been headed to overseas markets — predominantly from PADD 3 terminals. Figure 1 below shows total U.S. oil, gas and NGL production, split between what gets consumed domestically (green areas and left axis), what gets sent abroad from PADD 3 (dark-blue areas) and what’s exported from other regions (light-blue areas). (The brown lines and right axes show the percentages of U.S. production that is exported.) U.S. crude oil production has grown immensely, now up to 13.5 MMb/d, with roughly a third of that, or about 4 MMb/d, being exported — nearly all of it from PADD 3 terminals. For natural gas, about 20 Bcf/d — or 20% of Lower 48 production — is exported either as LNG or via pipelines, with the vast majority of LNG exports going out of PADD 3. Then there’s NGLs. Total U.S. production is about 7 MMb/d and 40% gets exported, most of it from Gulf Coast terminals.

U.S. Crude Oil, Natural Gas and NGL Production and Exports

Figure 1. U.S. Crude Oil, Natural Gas and NGL Production and Exports. Source: RBN

Join Backstage Pass to Read Full Article