Over the past two years the volume of crude oil shipped by rail from Canada has increased ten-fold. Data from the Canadian National Energy Board (NEB) for the whole of Canada indicates that average rail crude exports in the first quarter of 2012 were about 16 Mb/d. That volume grew to at least 160 Mb/d in the first quarter of 2014. The increase in rail exports of crude is primarily being driven by pipeline capacity constraints. Today we introduce findings from RBN Energy’s latest Drill Down Subscriber report.

|

|

N E W ! ! Go Your Own Way – The Road to Market for Canadian Bitumen Crude We have just released our seventh Drill-Down report for Backstage Pass subscribers reviewing WCSB crude production, the pipelines and rail terminals serving the region, and the challenges of moving that heavy oil production to market. More information on Go Your Own Way here. |

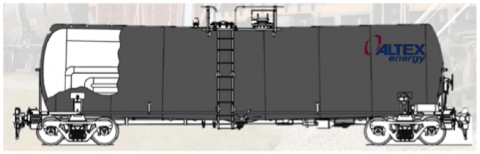

Canadian crude production has expanded steadily, rising by 900 Mb/d from 2.5 MMb/d in 2003 to 3.4 MMb/d in 2013 and an average of 3.6 MMb/d through April 2014. RBN expects total Canadian crude production to grow to more than 5 MMb/d by the end of 2019. Most of that new production will be heavy crude from bitumen in the Western Canadian Sedimentary Basin (WCSB) that is expected to increase from about 1.8 MMb/d in 2012 to 3.6 MMb/d in 2020. A growing portion of the expanding bitumen production will come from an enhanced recovery technology known as steam assisted gravity drainage (SAGD), which produces viscous bitumen that does not flow at surface temperatures. This crude has to be blended with up to 30% of lighter hydrocarbon diluent material to flow in pipelines (dilbit) but can be transported in specialized coiled and insulated rail tank cars (see picture in Figure #1) in an almost raw form (purebit) or with only 20% diluent (railbit).

Figure #1

Source: Altex Presentation (Click to Enlarge)

The most obvious market for Canadian bitumen is refineries in the US Midwest and initial pipelines out of Canada that were designed to feed that market. But now production has outstripped Midwest heavy crude refining capacity. The next most obvious market is the Gulf Coast that has over 1.5MMb/d of capacity well suited to heavy crude processing. However, the transportation distance from the oil sands region to the Gulf Coast is over 2000 miles and the expansion of pipeline capacity to get more Canadian barrels out of Canada and through the Midwest to reach the Gulf Coast has been slower than planned.

Pipeline access between the Cushing, OK Midwest trading hub and the Gulf Coast has improved in the past year. The TransCanada Cushing Marketlink southern portion of the Keystone XL project provided an additional 700 Mb/d of capacity in January and the Enbridge/Enterprise JV Seaway pipeline is set to expand by 450 Mb/d to 850 Mb/d between Cushing and Houston starting later this month (June 2014). The current pipeline bottlenecks between Western Canada and the Gulf Coast are further north – between Alberta and the Midwest. Here the principal delay is to the 830 Mb/d TransCanada Keystone XL project – still awaiting a permit from the State Department to cross the Canadian border. If and when that permit is granted it will take at least two years for the pipeline to be completed. And a similar delay is now impacting plans to expand the 2.5 MMb/d Enbridge Mainline pipeline between Hardisty, Alberta and Chicago. As discussed in our recent blog series on Enbridge’s Western Gulf Coast Access System (WGCAS) the expansion of the main heavy crude line (Alberta Clipper) between Hardisty and Superior, WS on the Enbridge Mainline is delayed by the same State Department permit process holding up Keystone XL. That delay reduces the pipeline capacity available to feed expansions to the Enbridge Southern Access (+ 160 Mb/d) between Superior, WS and Chicago and the new 600 Mb/d Flanagan South pipeline between Chicago and Cushing. [We describe these expansions south of Chicago in more detail in the upcoming Episode 2 of the WGCAS blog series.]

Join Backstage Pass to Read Full Article