PetroChina’s recent decision to offload its 20-year commitment to use the Trans Mountain Pipeline expansion (TMX) might seem like a bit of a head-scratcher on the surface, especially since Asian buyers have been expected to take advantage of the increased access to Western Canadian crude oil that TMX provides. But when you factor in the known challenges of utilizing the new pipeline and the reduced demand for crude oil in China, PetroChina’s decision to sell its commitment to Canadian Natural Resources Limited (CNRL) starts to make sense. In today’s RBN blog, we look at the challenges buyers face in using the TMX system despite its obvious perks.

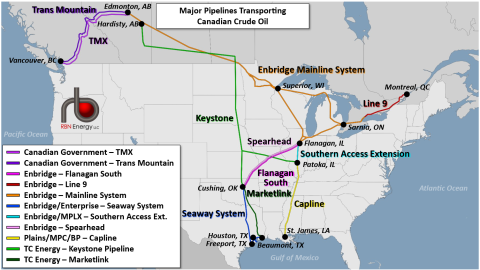

The TMX project was long marketed as a faster and more direct way to send Western Canadian crude to Asia, reducing the need to ship barrels by pipeline thousands of miles to the U.S. Gulf Coast (USGC) to be loaded onto a tanker. The 590-Mb/d TMX pipeline (light-purple line in Figure 1 below) was designed to ship mainly heavy crude from Edmonton, AB, to British Columbia and follows the same route as its older sibling, the 300-Mb/d Trans Mountain Pipeline (TMP; dark-purple line), which moves a variety of light crudes and products. The Westridge terminal near Burnaby, BC, with three new berths, has the capacity to export 630 Mb/d of crude but is limited to Aframax-class tankers, among the industry’s smallest. (More on that in a bit.)

Figure 1. Major Pipelines Transporting Canadian Crude Oil. Source: RBN

Throughout its construction, the TMX project was beset with problems and cost overruns (see On The Hunt). The ballooning budgets ultimately led to higher tariffs for TMX users, and many of the 11 committed shippers — a combination of refiners and producers — had signed take-or-pay contracts and filed challenges before the Canada Energy Regulator (CER). These contracts accounted for 80% of TMX’s capacity, with the remainder available for spot shippers. In December 2023, the CER approved the higher preliminary interim tolls, which were roughly double the estimate five years ago by operator Trans Mountain Corp. The CER will have a full hearing regarding the interim tolls in May 2025.

Join Backstage Pass to Read Full Article