Reversing the direction of flow on the eastern third of the Rockies Express (REX) pipeline would have a profound effect on natural gas markets throughout the industrial Midwest and the Midsouth. Not only would the plan significantly expand the regions’ access to gas from the Utica and western Marcellus shale plays, it would further erode the market shares held by traditional suppliers to those regions. In this Part 3 of our series on the REX reversal we examine how moving large volumes of now-constrained gas west from southwestern Pennsylvania, Ohio and West Virginia would fundamentally change regional gas flow patterns, basis relationships, and even the operations of many pipelines.

Recap From Parts 1 and 2

In Part 1 of this series we looked at how, just a few years ago, the Rockies were seen as a gas-market game-changer, much as the Utica and Marcellus plays are viewed today. Starting in late 2009, constrained gas supplies from the Rockies started moving 1,600 miles into Ohio and from there into the Northeast, filling a gas-supply void created by declining Gulf Coast production and falling gas imports from Canada. Now the tables are turned. The Northeast has ample reserves of newly tapped gas in Utica and Marcellus, and producers there—hurt by often large negative basis differentials (price versus Henry Hub) are desperately in need of new pipeline capacity to move increasing volumes of gas into nearby markets. For eastern Marcellus producers, that means New York/New Jersey, New England, and maybe south toward Virginia. For Utica and western Marcellus producers, it means the Midwest, Canada, Midsouth—places like Kentucky and Missouri, and even all the way to the Southeast Gulf region.

In Part 2, we looked at how quickly gas production has increased in Marcellus/Utica, and how pipeline developers are scrambling to catch up. The natural gas take-away capacity situation for Utica/western Marcellus producers in southwestern Pennsylvania, Ohio and West Virginia does not seem to be as problematic as it is for their counterparts in northeastern Pennsylvania, but it is certainly challenging. That’s where REX-East comes in. As the biggest west-east gas pipeline through the Midwest, a reverse-flow REX could prove to be as big a deal for Utica/western Marcellus producers as it was for Rockies producers just a few years ago. As we said last time, the REX reversal would start small as a backhaul [1], possibly as soon as 2014 with the delivery of up to 200 MMcf/d from a yet-to-be-identified Utica producer that holds a binding “precedent agreement” with REX. But that deal needs approval from the Federal Energy Regulatory Commission (FERC), and that is not a given. The reason is, the foundation and anchor shippers who contracted years ago for most of REX’s west-to-east capacity claim that under a “most-favored nation” clause they would be entitled the same low rates REX has promised the Utica producer. How this will play out is up in the air, but for the purposes of our analysis we’ll assume that REX gets the OK to charge rates that will make REX east-to-west flows economic, and that the pipeline retains enough west-to-east revenue to make its financial commitments.

Moving Marcellus/Utica Gas Out of the Northeast Region

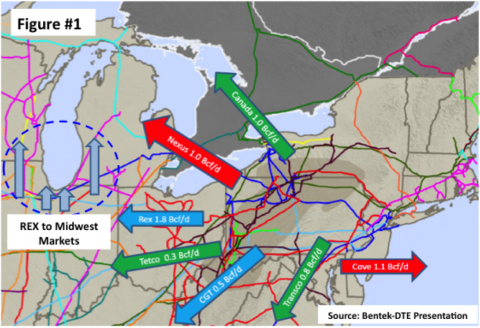

We also reviewed growth projections for Marcellus/Utica production in Part 2 – up from just over 12 Bcf/d to more than 18 Bcf/d in 2018, and examined a number of pipeline projects in addition to REX that are designed to move these growing supplies out of the Northeast region. Figure #1 below from a recent Bentek presentation to a DTE customer group shows many of the planned capacity additions. (For more information on several of these projects see Part 2.) As noted above, dry or “residue” gas volumes from the “wet” portion of the plays in southwestern Pennsylvania, Ohio and West Virginia are expected to move into the Midwest and Midsouth markets, up to Dawn on the proposed Nexus project and in some cases like the Columbia Gas Transmission (CGT) project, perhaps all the way down to the Southeast/Gulf region providing access to Gulf LNG export facilities. We have added the oval and arrows to the west of the Marcellus/Utica play indicating the markets that most westward REX shipments would likely target – Chicago and Michcon.

There are huge natural gas markets in and around Chicago and the DTE Michcon pipeline/storage facilities (90 BCF of storage capacity for DTE alone!) in Michigan. With such a vast storage capability in the region providing the ability to soak up volumes in the low-demand summer season, and the fact that these are the closest large markets to the Marcellus/Utica region, it is clear that these markets will be the first choice for Marcellus/Utica volumes outside of the Northeast. But it is not like these regions do not have enough gas supply right now. Much of the Marcellus/Utica gas that comes into these markets will displace traditional sources of supply. So who is the odd man out?

(Click to Enlarge)

Displacement in the Midwest Markets

Figure #2 below shows the changes expected for the Midwest market based on the Bentek Cellcast flow analysis between 2013 and 2018. This is Bentek’s regional supply/demand balancing model that we also used back in 2012 (see End of the World as We Know It) to describe the implications for Northeast flow reversals. Here we show how those reversals will back up into the Midwest.

The expected swing for Northeast/Midwest flows (mostly on REX) flips from about 0.5 Bcf/d moving west-to-east today to 1.7 Bcf/d moving east-to-west by 2018 yielding a 2.2 Bcf/d net reversal of flows into the Midwest region (blue arrow). The most significant piece of supply pushed out by these Marcellus/Utica volumes is net Canadian imports that decline 0.9 Bcf/d during the period (red arrow). That does not mean all Canadian gas is gone. There will still be about 0.7 Bcf/d of Canadian imports into the Midwest in 2018, with most of that volume being injected into storage during the summer at prices discounted to move the supplies. There will be nowhere else for Canadian producers to go with this piece of their gas supplies.

As you might expect, the other displaced supply region is the Rockies. But the Rockies inflows only fall by 0.4 Bcf/d (red arrow) to about 1.7 Bcf/d. Thus there is a lot of Rockies gas that continues to move into the Midwest region even after reversal of the eastern one-third of REX. The Western portion of REX and other routes to get Rockies gas into the Midwest will continue to push gas into the region – again because it is a market that can absorb supplies.

One reason that the region can take these volumes is expected increases in demand. And that is a big assumption of this scenario – a 0.9 Bcf/d net increase of demand over local (Midwest) production growth (red box). Although production will be increasing (mostly from the North Dakota Bakken, included in Bentek’s Midwest region), the combination of gas fired power generation, industrial demand and residential/commercial demand will more than offset the increase. Of course, if this demand does not materialize, more gas will be pushed back into Canada and the Rockies.

Note that there are other flow changes from the Midcontinent and Southeast Gulf regions over the period in this scenario that basically cancel out. Thus the implication is that most Northeast volumes will be displacing Canadian and Rockies supplies, or taking advantage of market growth. Any volumes that “move” all the way down to the Gulf Coast during this timeframe will likely be by displacement [1] not by physical reversal of pipelines.

Join Backstage Pass to Read Full Article