Beginning in 2020 and so far through 2021, we at RBN have devoted a lot of our energy to covering the latest developments in environmental, social and governance (ESG) trends in the energy sector. That’s no accident – in fact, it’s been a necessity. As we recently discussed in Bullet the Blue Sky, environmentally focused initiatives have taken center-stage as society, investors, and governments demand higher standards from companies. The consequences to businesses that don’t heed the new paradigm could be dire for both their reputations and their pocketbooks. As a result, companies up and down the energy value chain have begun examining their operations to identify areas of improvement, particularly as it relates to their greenhouse gas (GHG) emissions. In today’s blog, we’ll focus on one of the most significant of GHGs – methane. We will look at what’s being done to monitor and address those emissions, and how companies may ultimately benefit by reining them in.

Amid growing pressure to address climate change, companies around the world are spending more time and money than ever before to ensure they are viewed as one of the good guys, rather than part of the problem. Many have trained their focus on their carbon footprint and are working to either offset CO2 emissions (see A Matter of Trust, Part 3) or capture and permanently sequester them (check out our recent It’s a Gas: CO2 webinar). But while CO2 gets the lion’s share of the press because of its status as the most prevalent GHG emitted (about 80% by volume of CO2 equivalent), it’s by no means the most potent.

To compare the atmospheric warming effect of various GHGs, the Environmental Protection Agency (EPA) uses a measure called the Global Warming Potential or GWP. It defines GWP as a measure of how much energy the emissions of 1 Metric Tonne (MT) of a gas will absorb over a given period of time, relative to the emissions of 1 MT of CO2. So, by definition, CO2 has a GWP of 1. The bigger the GWP value, the more that gas warms the earth compared to CO2 over that time-period, which is usually 100 years. Based on that measure, methane, the primary constituent of natural gas, has a GWP estimated at somewhere between 25 and 36 times that of CO2. However, methane emissions are neutralized after a decade or two in the atmosphere, meaning that their up-front GWP is much higher, more like 86 times that of CO2 if normalized to a 20-year timeline.

And that represents both a problem and an opportunity. On one hand, with methane making up roughly 8 billion MT of CO2 equivalent (BT CO2 e) emissions globally each year and 650 MMT CO2 e in the U.S. (about 10% of total U.S. GHG emissions), the potential atmospheric warming effects are substantial. On the other hand, the effective detection and management of methane emissions could have huge near-term dividends, and that’s begun to grab more attention recently. One prominent example, the climate report recently released by the IPCC (under the auspices of the U.N.), recently highlighted the role of methane as a significant GHG contributor.

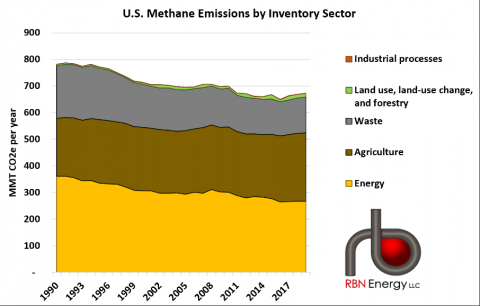

As shown in Figure 1, below, methane is emitted from three main sources: agriculture (38%; brown area in Figure 1; see That Smell), waste (20%; gray area; see I Love Trash) and notably for this discussion, energy (40%; yellow area) – specifically the upstream and midstream in the gas sector.

Figure 1. U.S. Methane Emissions by Inventory Sector. Source: EPA

According to the U.N. Global Methane Assessment, there are readily available targeted control measures that can reduce more than 30% of projected anthropogenic (human-caused) methane emissions in this decade. As stated at the outset, this isn’t the first time we’ve touched on methane emissions recently. In our blog Paradise, Part 3, we highlighted some of the efforts being made to reduce Scope 1 GHG emissions (which are GHGs directly released by the facilities and equipment that a company owns or controls) including expanding their leak and detection programs, switching to reduced emission pneumatic devices, cutting pipeline emissions, and reducing venting and flaring.

Regarding the first of those, programs designed to enhance leak detection and repair have become commonplace at midstream companies to meet regulatory reporting requirements, including the federal Pipeline Hazardous Materials & Safety Administration’s (PHMSA) new Gas Mega Rule, but many have been voluntarily expanding their use to further reduce the volumes of methane, CO2 and other GHGs that leak from their pipelines, compressor stations, and gas processing plants. However, one need not look far to find headlines saying that the carbon intensity (CI; see Come Clean for how that works) of fossil fuel production has been historically underestimated because of methane leaks

Methane is volatile at ambient temperature and pressure, meaning that it can escape or boil off into the surrounding atmosphere. Rather than monitor actual emissions, companies are only required to report estimated emissions to the EPA on a periodic schedule and only some of them are required to perform periodic leak detection inspections. Unfortunately, the intermittent nature of emissions means that significant discrepancies can arise between estimates reported to the EPA and measurements taken by independent scientists, satellites, and NGOs. But independent observers, such as Project Canary, a Denver, CO-based emissions data and gas certification company, utilizes high-fidelity continuous monitoring sensors to catch leaks that can occur in minutes and hours, rather than reporting weeks or months after the fact. While many companies in the gas business, notably Cheniere and EQT have made huge efforts to enhance their monitoring programs, ultimately, transparency will be needed to confirm the companies’ efforts are paying off and for that, third-party measurement and certification could be sought.

Project Canary, for example, collects methane emissions data through continuous monitoring technology. It then analyzes the data through a Software-as-a-Service (SaaS) platform to measure the effectiveness of leak prevention efforts. This puts accurate data in the hands of operators who can measure and mitigate emissions in real-time. That real-time analysis is combined with a boots-on-the-ground well-pad by well-pad assessment of an operator’s infrastructure and whether or not best practices have been followed and the best equipment used to minimize problems. And rather than being considered in a vacuum, its evaluation is made in the localized context of an overall impact to the air, water, land and community. Operators who meet Project Canary’s uncompromising, 600-point standards are awarded their TrustWell certification. And such endorsements have real value in dollars and cents.

Natural gas is a commodity that implies that the molecules at the same place and time all have the same value, all other things being equal. But gas that has been certified as responsibly sourced is differentiated and could therefore attract a higher value. Who might be willing to pay up for such gas? Well, as we discussed recently in A Matter of Trust, the LNG sector is making inroads in the use and development of carbon offsets and low-carbon gas. Additionally, both investor-owned utilities and public utility companies (PUC) have shown a willingness and desire to offer low-carbon natural gas to their customers. To the extent that state and local governments wish to do their part to reach carbon-neutral goals, they may also target low-carbon gas. States like Massachusetts, Colorado, New Jersey, Maryland and D.C. all have stated goals to reduce their carbon impact and their utilities are buying certified natural gas as a way to meet these ambitious commitments. Following the first pilot purchase in 2018 between New Jersey Natural and SWN, utilities are now scaling up their commitments to buy certified gas. Other utilities have taken note including Xcel, Colorado Springs Utilities, Vermont Gas, and EIP. While the premiums paid on certified gas have been modest up to this point, the increasing cost of carbon globally could cause them to rise further.

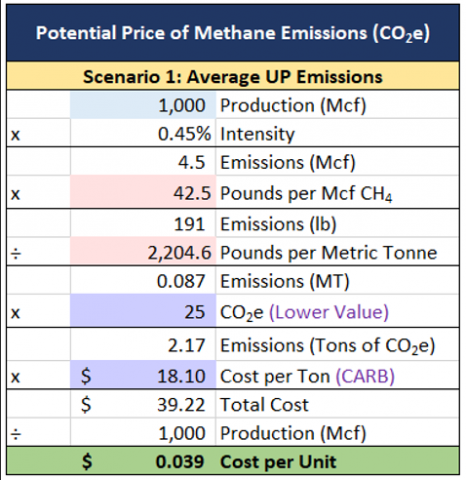

We can actually estimate the current value of lower-carbon gas. Say, for example, an upstream producer (UP) that produces 1,000 Mcf/d, has a methane intensity of 0.45%, which is pretty close to the industry average. We’ll work on the assumption that carbon has a price of $18.10/MT of CO2 equivalent (MMT CO2e), which was the value in the latest auction by the California Air Resources Board (CARB), (which is less than half the price of EU ETS, meaning this number could very well rise in time). To be conservative, we’ll take the lowest possible GWP for methane, stated above: 25. Under this scenario, the carbon-equivalent cost of the producer’s methane emissions would be $0.039/Mcf. The math is shown in Figure 2 below.

Figure 2. Potential Price of Methane Emissions: Average UP. Sources: Project Canary, RBN, EPA

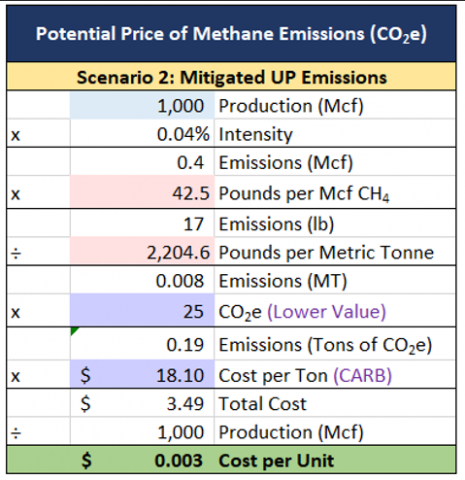

Now let’s say that, with the use of continuous monitoring and remediation, the producer is able to reduce emissions to 0.04%. Now the carbon-equivalent cost of its methane emissions drops to just $0.003/mcf (Figure 3).

Figure 3. Potential Price of Methane Emissions: Mitigated Emissions. Sources: Project Canary, RBN, EPA

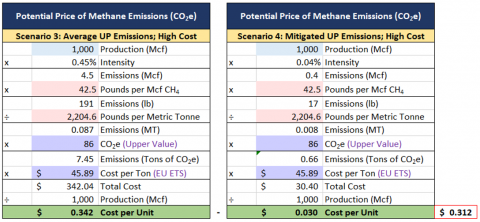

Based on that calculation, the producer could justify a $0.036/Mcf premium for its gas ($0.039 - $0.003 = $0.036) as it could be certified as a cleaner source than the industry average. Again, this scenario is not even close to the highest conceivable cost. If the GWP used is 86 (again, based on the 20-year scenario), the carbon-equivalent cost of methane emissions rises to $0.135/Mcf. And, finally, if the GWP is 86 and the price of carbon is $45.89 (roughly the price of EU ETS), the price differential rises to $0.312/Mcf (red box in Figure 4).

Figure 4. Potential Price of Methane Emissions: High Scenarios. Sources: Project Canary, RBN, EPA

Now, all of thismaysoundfar-fetcheduntilyourememberthatindustry leaders such as the American Petroleum Institute (API) and their diverse membership, have advocated for a carbon tax. And that’s creating a strong incentive for companies to seek the expertise of the likes of the aforementioned Project Canary to certify their gas using the highest, independent standards so that they can more effectively monitor and address methane leaks and capitalize on the emerging market for low-carbon gas.

The experience of Project Canary’s co-founders gives them insight into helping clients capture that value. Chris Romer, CEO, is a former Colorado state senator, has experience in public finance, and has seen first-hand how financial markets could be harnessed to build greener infrastructure. Dr. Anna Scott, Chief Science Officer, has led the charge, pushing for the continuous monitoring of industrial assets and her efforts have revealed insights from data that was previously ignored. Finally, William Foiles, Chief Operating Officer, noting the wishy-washy methodologies that tend to obscure the true picture of an asset’s impact, has ensured the rigor around Project Canary’s environmental assessments and established a high bar of data accuracy which may one day become the industry standard.

The ESG movement has arrived like a tsunami bringing with it the tides of an energy transition. While decarbonization and transition timelines are still in flux, we appear to be on the cusp of monumental changes, and markets are adjusting rapidly. One thing is certain – the world’s energy supply mix will change and end-users will continue to demand lower carbon intensity energy sources.

"Free Bird" was written by Allen Collins and Ronnie Van Zant, and appears as the last song on side two of Lynyrd Skynyrd's debut album, (Pronounced Leh-nerd Skin-nerd). The band had been working on the song at Hell House, their rehearsal cabin in Green Cove Springs, Florida. No one in the band was initially enamored with the song, but they made a demo of it to consider for their first album. Guitarist Allen Collins and Gary Rossington started playing a guitar jam at the end of the song when playing it live to give vocalist Ronnie Van Zant a chance to rest his voice. When pianist Billy Powell joined the band and came up with the intro to the song, the soon to be legendary nine-minute song was born. It became the closing or encore song at all Lynyrd Skynyrd shows. Originally released as a single in November 1974, the song went to number 38 on the Billboard Hot 100 Singles chart. Personnel on the record were: Ronnie Van Zant (vocals), Allen Collins (electric, acoustic guitar), Gary Rossington (electric, slide guitar), Ed King (bass), Bob Burns (drums), Billy Powell (piano), and Al Kooper (organ, Mellotron). In 1988, Will to Power released a single of a medley of "Free Bird" with Peter Frampton's "Baby, I Love Your Way, " that went to number one on the Billboard Hot 100 Singles chart.

(Pronounced Leh-nerd Skin-nerd) was recorded between March-May 1973 at Studio One in Doraville, Georgia, with Al Kooper producing. Released in August 1973, the album went to number 27 on the Billboard 200 Albums chart. It has been certified 2x Platinum by the Recording Industry Association of America. Two singles were released from the album.

Lynyrd Skynyrd is an American rock band formed in Jacksonville, Florida in 1964 under the name My Backyard, with Ronnie Van Zant, Gary Rossington, Allen Collins, Bob Burns, and Larry Junstrom. The band changed their name to Lynyrd Skynyrd in 1969, after their gym coach, Leonard Skinner, who was always kicking them out of school for their long hair. After a plane crash during a tour in October 1977 that killed lead singer Ronnie Van Zant, guitarist Steve Gaines, and backing vocalist Cassie Gaines, and seriously injured the rest of the band, the group retired until reforming again in 1987. They have released 14 studio albums, six live albums, 23 compilation albums, and 30 singles. They were inducted into the Rock and Roll Hall of Fame in 2005. Twenty-nine members have passed through the band since its formation. They continue to tour, and according to lead vocalist Johnny Van Zant, have intentions "to record one last album" before completing all of their tour obligations.