U.S. crude stocks are at their highest level in over 30 years and the contango market pricing structure continues to encourage increases in the stockpile. No one knows exactly how much storage space remains. The surplus is keeping U.S. crude prices low compared to international rivals but petroleum product prices (gasoline and diesel) are climbing higher, having bounced back from recent lows. Refining margins are sky high as bad weather and outages hamper operations. But as we describe today, the crude surplus remains a dark cloud on the horizon.

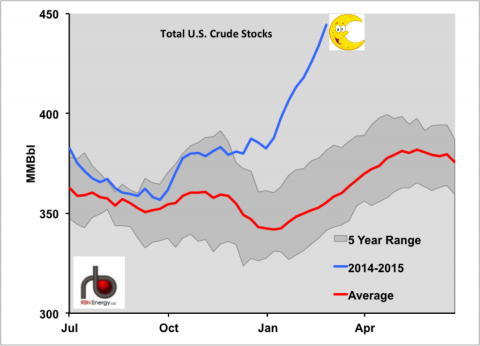

According to the Energy Information Administration (EIA) the nation is officially awash with crude supplies – stocks are up by 62 MMBbl since January 1st 2015 to 444 MMBbl at the end of February – highest ever (since EIA started the tally in 1982 – 33 years ago). About 10 MMBbl of crude was added to inventory between February 20, 2015 and February 27, 2015. The chart in Figure #1 shows total U.S. crude stocks since July 2014 (blue line – flying towards the moon) as well as the 5-year average (red line) and the 5-year range (darker gray area). The chart shows current levels 25% above the 5-year average and well outside the normal range for this time of year. About half of the inventory is located in the Gulf Coast region (220 MMBbl) and another 33 percent in the Midwest – the two principal refining regions. Depending on the amount of crude that U.S. refineries process (it varied seasonally between 15 and 16 MMb/d last year) current crude stocks are enough to supply refineries for between 27 and 30 days – about a month. All of these “commercial” supplies are on top of the 690 MMBbl Federally mandated Strategic Petroleum Reserve (see Save It For A Rainy Day).

Figure #1 – Source: RBN Energy, EIA data from Morningstar (Click to Enlarge)

There is absolutely no sign of a let up in the inventory build – with the only constraint appearing to be storage space to squirrel away more barrels. According to an EIA “Today In Energy” analysis last week, U.S. crude inventory took up about 60% of available capacity by February 20, 2015 and based on their reckoning have increased another 2% in the week following. The truth is that no one knows how much storage is really available. We do know that as storage gets harder to find, the cost of leasing it will continue to go up. Those increased storage costs will have an impact on crude market contango. As we explained recently contango occurs when prices for future delivery are higher than prices today (see Skipping The Crude Contango). If the contango spread is wide enough to cover the cost of leasing storage space, then traders can lock in a profit by putting crude into storage today and selling futures contracts for delivery at higher prices.

Join Backstage Pass to Read Full Article