Crude-oil-focused production in the Bakken still hasn’t fully recovered from its pre-COVID high, partly because the western North Dakota shale play continues to face takeaway constraints, especially for natural gas and NGLs. A couple of NGL pipeline projects in the works will certainly help, but will they be enough to enable the Bakken’s increasingly consolidated E&P sector to ramp up its crude oil production? And one more thing: How will the incremental NGLs flowing south on Kinder Morgan’s soon-to-be-repurposed Double H Pipeline find their way to fractionation centers in Conway and Mont Belvieu? In today’s RBN blog, we’ll look at the Bakken’s complicated production-vs.-takeaway conundrum and the ongoing efforts to address it.

The Bakken was one of the first beneficiaries of the Shale Revolution — from 2009 to 2019, crude oil production there increased more than 10-fold, topping out at about 1.5 MMb/d before the pandemic hit and the play’s output cratered to 900 Mb/d. Production has rebounded somewhat, but remains range-bound near 1.2 MMb/d, well short of its potential. A major reason for the flat-line crude output is that old stumbling block — pipeline takeaway capacity — not so much for crude oil (though that is a lingering concern) but for natural gas and NGLs because, as it turns out, the most prolific oil-focused wells in the Bakken also produce large volumes of liquids-rich associated gas.

As we discussed in Take It To The Limit, the gas-to-oil ratio (GOR) in the Bakken is now well over double what it was a decade ago. While a producer extracted only 1.1 Mcf of gross associated gas for each barrel of crude oil produced, on average, in 2014, that number is now 2.7 Mcf. And the gas packs plenty of NGLs — as much as 9 gallons (or more!) per Mcf, or GPM. Altogether, the Bakken churns out 730 Mb/d of potential NGL production, about 443 Mb/d of which is ultimately recovered with the rest “rejected” into natural gas for its Btu value.

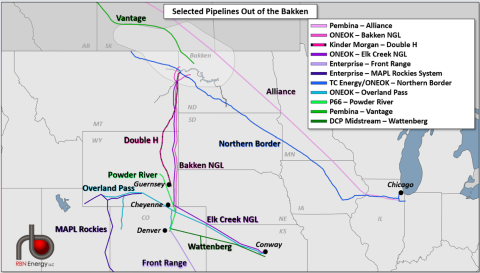

All of which brings us to the Bakken’s pipeline-takeaway specifics, the plans by ONEOK and now Kinder Morgan to add new NGL pipeline capacity, and what they mean for the basin, its producers and its production. As we discussed earlier this year in Take It to the Limit, there are five main ways to move NGLs out of the Bakken: (1) mixed NGLs entrained within “wet” gas on Enbridge and Pembina’s Alliance pipeline (light pink line in Figure 1) to the Chicago area (where the NGLs are separated out), (2) ethane rejected into gas on the Northern Border pipeline (dark-blue line), (3) ethane piped north to Canada on Pembina’s Vantage Pipeline (medium-green line), (4) mixed NGLs piped south to Conway on ONEOK’s Elk Creek and Bakken NGL pipelines (medium-purple and dark-pink lines, respectively), and (5) so-called C3+ NGLs (propane, butanes and pentanes) either trucked or railed away — ethane can’t be transported that way.

Figure 1. Selected Pipelines Out of the Bakken. Source: RBN

Join Backstage Pass to Read Full Article