Crude prices closed yesterday at $81.90/Bbl - an 8 month low. Gasoline and heating oil also posted 2012 lows. These falling prices come on the heels of a tough year for East Coast refiners that saw more than 25 percent of refining capacity shut down. Of the remaining capacity, nearly a third - at the Sunoco Philadelphia refinery is due to close in July. Why are East Coast refiners running for the exits? How will the region secure refined product supplies without refineries? In “Don’t Let The Sun Go Down On Me - East Coast Refining Part I”, we look at why crude economics aren’t working in the region and the impact that refinery closures will have on gasoline supplies.

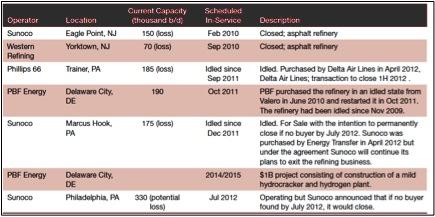

The Energy Information Administration (EIA) defines the East Coast of the United States as PADD 1. (The acronym PADD stands for Petroleum Administrative District for Defense and dates back to World War 2). PADD 1 has refineries in Delaware, Georgia, New Jersey, Pennsylvania and West Virginia. In the summer of 2011 these refineries had combined capacity of 1.3 MMB/d but since then 0.36 MMB/d or 26 percent of that capacity has been shut down. Table 1 below shows a list of the refinery closures. The 0.3 MMB/d Sunoco refinery in PA representing about one third of the remaining capacity is due to close in July 2012 if a buyer cannot be found. Sunoco are said to be in last minute discussions with the Carlyle Group to keep the refinery open.

Source: Canadian Association of Petroleum Producers

As noted previously here the East Coast is virtually marooned from domestic crude supplies except for complicated transport schemes to reach Philadelphia from the Bakken (see Rail it on Over to Albany: Moving Bakken East). There is no crude pipeline infrastructure to link the region to Midwest or Canadian supplies. As a result, East Coast refiners rely on crude imports, primarily light sweet or light/medium sour crudes to meet 80 percent of their feedstock requirements. [As a side note, it is a sad twist of fate that the yet to be developed Utica Shale play lies close to the East Coast and is expected to produce 150 MB/d of light sweet crude by 2017 - too late to save the day for many of the weaker East Coast refiners.]

Light sweet crudes being imported into PADD 1 are priced relative to Brent. Most US domestic crudes are priced relative to WTI Cushing. For many years the WTI price traded at a slight premium to Brent until 2010. In that year, rising US domestic crude production and Canadian imports put downward pressure on WTI prices at Cushing and Brent prices rose above WTI. Since the beginning of 2012, the Brent price has been trading at a $10/Bbl to $20/Bbl premium to WTI. Although that premium has recently dropped to $11/Bbl and fell again yesterday to $10.79/Bbl, higher Brent related crude prices have strained Northeast refinery economics and encouraged refiners to head for the exits.

The disincentive for refiners to run expensive crudes when the economics don’t make sense can be seen in EIA reported refinery operations data. Chart 1 below shows the Brent/WTI spread in red against the right scale and the PADD 1 Percent Refinery Operation in blue against the left scale. You can see that whenever the Brent/WTI spread widened, PADD1 refiners reduced their operating throughput (as measured by EIA refinery percent operation data). As the Brent/WTI spread has narrowed in recent weeks refinery operations have picked up, but at 81.3 percent, they remain well below nationwide refinery operation levels of 92 percent.

Join Backstage Pass to Read Full Article