U.S. oil, natural gas and NGL markets are more interconnected than ever — with each other and with global dynamics. The deep connections we see today have evolved in the 15 years since the start of the Shale Revolution, and in recognizing how the various segments have impacted one another, we can better explain how they are driving today’s markets. That was the focus of our Fall 2023 School of Energy and it’s the subject of today’s RBN blog, which (warning) is a blatant advertorial for School of Energy Encore, a newly available online version of our recent conference.

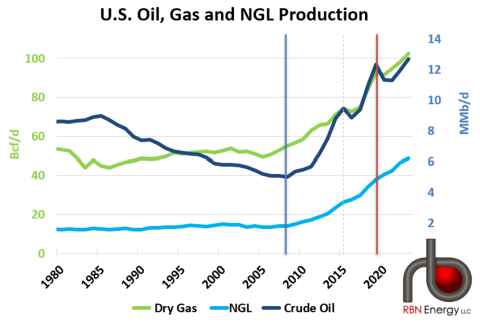

The School of Energy conference, as the name implies, is designed to teach energy professionals what they need to know about the U.S. energy industry. We begin with the basics — the fundamentals of how domestic energy markets function — in Module 1. As we do, we provide context for how these markets developed to where they are today and insight into how they are fundamentally interconnected. The first, most basic connection we covered at the School of Energy was the common origin of crude oil, natural gas and NGLs. While the mix of those commodities varies widely from basin to basin and even well to well, they all come out of the ground as an intermingled stream. So, the development of one resource will inevitably impact the others. Likewise, any disruption in one stream, be it logistical or related to markets, will also cascade into the others. That’s what the second of five major modules of the School of Energy is all about.

Figure 1. U.S. Oil, Gas and NGL Production. Source: RBN

Join Backstage Pass to Read Full Article