According to a new study just released by Turner Mason titled “North American Crude and Condensate Outlook” (NACCO), U.S. crude oil production could nearly double between early 2012 and 2022. At least that is the Study’s “high case” production scenario. That is very good news for U.S. refiners. Perhaps less good is the fact that 80% of the volume growth is light sweet crude, super-light crude, or even lighter condensate. How will refiners digest all of this light crude and what impact will the growing supply have on price differentials? What will the surge of light crude mean for waterborne and Canadian heavy crude imports? Today we start a two-blog series that will examine some of the findings of TM&C’s “2013 North American Crude and Condensate Outlook” (NACCO).

We’ve looked at this issue before when we reviewed last year’s study in Turner Mason and the Goblet of Light & Heavy. We described the ‘dumbbelling’ of crude oil supplies in North America: On one end of the API spectrum, U.S. crude getting much lighter and on the other, growth in Canadian imports will be almost exclusively heavy. The previous report also explored the implication for product yields, gasoline and distillate exports, the capacity logjam at Cushing, and the impact on refinery capacity, recognizing that there was a lot of uncertainty hanging over the market.

Some of that fog of uncertainty has lifted over the past few months and the 2013 NACOO pulls recent market developments into an updated view of the crude oil market. We now know that U.S. crude oil production is coming on much faster and much lighter. We know that the Brent vs. WTI differential has already narrowed due to increasing capacity between Cushing/West Texas and the Gulf Coast. And we know that crude-by-rail is here to stay. In the paragraphs below we’ll look at these issues in more detail.

|

All of these crude supply issues are examined in TM&C’s 2013 North American Crude and Condensate Outlook”, For more information, visit www.turnermason.com or call 877-327-7676. |

U.S. Crude Oil Production Growth

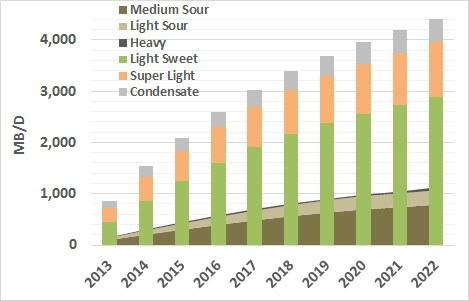

The graph below in Figure #1 shows TM&C’s ‘high case’ U.S. crude oil production growth forecast for six key crude grades. The bars show the growth in light sweet crude oil production from a 2012 base. This category includes ‘classic’ light sweet in the green bars (31-42 degrees API), super light sweet in orange bars (42 – 55 degrees API) and condensate in gray bars (55 degrees API or higher). Growth in these three grades is expected to be 4.4 Mb/d from 2013 to 2020, with 65% of the increase coming from light sweets, 25% from super lights, and 10% from condensates. The growth rates for super lights and condensates over 2012 are 185% and 200% respectively.

U.S. light sour and heavy grades are projected to grow, but not nearly as fast as the light sweets. The medium sour category shows the most significant growth (24 – 31 degrees API, ≥1.0 % sulfur; dark brown area), increasing by about 80%. Light sour (31 – 42 degrees API, ≥1.0 % sulfur; light brown area) grows by 50%. Growth in U.S. heavy crude oil is insignificant.

Figure #1 US Crude Oil Production Growth Source: Turner Mason (Click to Enlarge)

The vast majority of the production growth – over 80% – comes from only four production fields: Williston Basin (Bakken), Permian Basin, Eagle Ford and the Gulf of Mexico. The light crude, super-lights and condensates come from the Williston and Eagle Ford, with the Permian also supplying significant volumes of the lighter crudes. The medium sour crude is mostly sourced from growing production from the Gulf of Mexico, which is clearly on the rebound.

Over the next few years, a significant portion of the light crudes and condensates will ‘charge’ into the Gulf Coast region, pushing out light sweet imports by the end of 2013 and then starting to back out light and medium sour grades. This will have a big impact on refinery economics and crude quality differentials that we will explore in part 2 of this blog series.

Canadian Crude Oil Production Growth

The quality of growing Canadian production is at the opposite end of the API gravity spectrum. Almost all of the increase making its way to the U.S. will be bitumen from oil sands. There are two sources for this material. The first is mining – actually digging the bitumen out and processing the oil sands to make bitumen crude, a super-viscous, 8 to 10 API crude that does not flow unless heated, diluted or upgraded. The second is steaming it out – pumping high pressure steam into the oil sands formation down one well so the bitumen will get hot enough to flow where it can be recovered by another nearby well. We’ve covered the bitumen market in a number of blogs including It's a Bitumen, oil - Does it go too far? and Crude Loves Rock’n’Rail – Heat It!

Canada’s numbers are big. Proven reserves are 173 billion barrels, which drastically exceeds U.S. proved reserves at 25 billion barrels, and ranks third in the world behind both Saudi Arabia and Venezuela. Approximately 98% of Canada’s reserves are oil sands.

That translates into equally strong production growth, as shown in Figure #2 below. There is another wrinkle to keep in mind when looking at crude from Canada. Most of the imports are bitumen, and most of the bitumen volumes come along with diluent. That means to get total Canadian imports (shipments) you must add together production plus the diluent volume that was added to make the shipments flow. It is that total shipment number that is shown in Figure #2, which is expected to increase at a 10% annual growth rate for 2013 before dropping to roughly a 5% annual growth rate for the rest of the decade. This represents a shipment increase up to 6.0 million barrels per day in Canada as a result of oil sands development by 2022.

Join Backstage Pass to Read Full Article