Midland, TX, is the epicenter of the Permian Basin. As the largest crude oil hub in the region, it boasts about 20 MMbbl of crude oil storage and extensive downstream connectivity, with the ability to deliver to local refineries, Wichita Falls, Cushing, Nederland, Houston and even Corpus Christi (albeit indirectly). It’s also where Midland WTI pricing is assessed, shaping much of the broader oil market in the region and even around the world. In today’s RBN blog, we discuss why Midland is the center of it all.

Midland earned its moniker in 1884 as the midway rail point between Fort Worth and El Paso. Founded in 1881, its early days revolved around railroads and shipping cattle to market, but the discovery of oil in the 1920s rapidly transformed the town into the hub of the Permian’s booming oil business. In 1923, the Santa Rita No. 1 well, which is generally viewed as the Permian’s first commercial well, sparked interest in what became the prolific Yates Oil Field and played a critical role in fueling this transformation, injecting significant wealth into the region. The well proved that the Midland Basin held vast oil reserves, propelling the town of Midland’s growth as the center of the region’s oil operations.

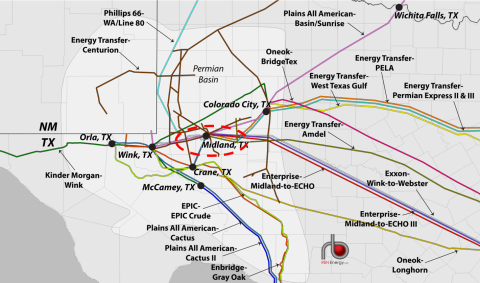

Figure 1. Permian Crude Oil Pipelines. Source: RBN Crude Oil Permian

In the decades since, the Midland area (dashed red oval in Figure 1 above) has cemented its place at the heart of Permian oil production. But how does Midland fit into the broader landscape of Permian takeaway capacity? Simply put, it’s the hive — the center of the action when it comes to receiving and sending out West Texas crude.

There have been ups and downs along the way. In 2013, Midland seemed poised to cement its status as a major oil town with ambitious plans for the Energy Tower, a 59-story skyscraper that would have been one of the tallest buildings in Texas — and the tallest outside Houston and Dallas. Just a year later, however, oil prices began to plummet, drastically reducing investor confidence in the project, which was officially scrapped by 2016. The failure of the Energy Tower project became a stark reminder of the volatility that defines commodity-dependent towns. While Midland had “arrived” on the global oil stage, the canceled plans underscored how quickly fortunes can shift in oil markets, where boom-and-bust cycles often dictate the economic landscape.

Join Backstage Pass to Read Full Article