The original Cactus Pipeline was a pioneer in moving large volumes of crude oil from the Permian and the Eagle Ford to the Corpus Christi area, which quickly became a leader in U.S. crude exports. Cactus II, an even longer and larger pipeline that came online in H2 2019, only added to Corpus Christi’s export prominence. But the competition with Permian-to-Houston pipelines is fiercer than ever and negotiated rates on pipelines to the Texas Gulf Coast are under pressure. In today’s RBN blog, we look at the Cactus I and Cactus II pipelines and their significance.

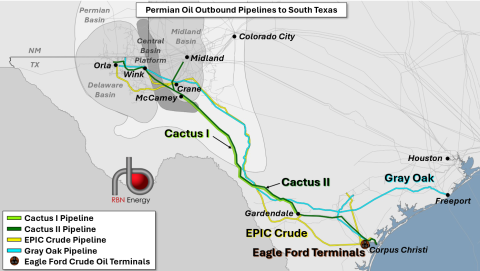

This is the latest in our series on crude oil pipelines traveling from the Permian Basin to the Gulf Coast. Today’s blog focuses on the last of the Corpus-bound pipes. Previously, in Bustin' Out, we looked at the EPIC Crude Pipeline (yellow line in Figure 1 below), which has been operating at full capacity, and then told the story of Gray Oak Pipeline (aqua line) in Movin' On Up. We recently wrapped up our Permian-to-Houston series with a new Drill Down Report, West Texas Highway, where we detailed how Corpus Christi is competing head-to-head with the Houston area to attract Permian barrels. Corpus Christi surpassed Houston as the top dog in Q1 2025, with Permian-to-Corpus flows averaging 2.5 MMb/d compared to Houston’s 2.4 MMb/d, according to RBN’s weekly Crude Oil Permian report. (In 2024, Houston outpaced Corpus for half of the months.) Combined, the two regions receive about three-quarters of the Permian’s output. Corpus Christi is an ideal spot for crude because it’s home to 857 Mb/d of refining capacity and has extensive export options, including Enbridge Ingleside Energy Center (EIEC) and Gibson’s South Texas Gateway (STG), the top two crude export terminals along the Gulf Coast by volume. (More on those in a bit.)

Figure 1. Permian Oil Outbound Pipelines to Corpus Christi. Source: RBN

Before diving into the details of Cactus I and Cactus II (light-green and dark-green lines, respectively, in Figures 1 and 2), which account for more than one-third of Permian-to-Corpus volumes, let’s discuss the origin story of Plains All American and how the ownership of the Cactus pipelines, which don’t share the same infrastructure, has morphed over time. Back in the 1980s and early ’90s, Plains Resources, a small E&P, expanded into the midstream sector, and in 1998 the company’s midstream subsidiary was spun off via an initial public offering (IPO) and simultaneously acquired All American Co. Ever since, it’s been Plains All American.

In the early years of the Shale Era in the Permian, Plains developed the Cactus Pipeline (later renamed Cactus I), which came online in 2015. Plains continues to own 100% of the pipeline and operates it. Cactus II’s ownership is a more complicated story. Completed in late 2019 and operated by Plains, the pipeline has been a joint venture (JV) since the start. Plains initially held 65%, with Western Midstream owning 15% and other partners (including Enbridge) holding the remaining 20%. Plains and Enbridge jointly bought out Western Midstream’s 15% interest in November 2022, with Enbridge acquiring 10% and Plains taking the other 5%. The agreement eventually resulted in Plains owning 70% and Enbridge owning 30% of Cactus II, which is where things stand today.

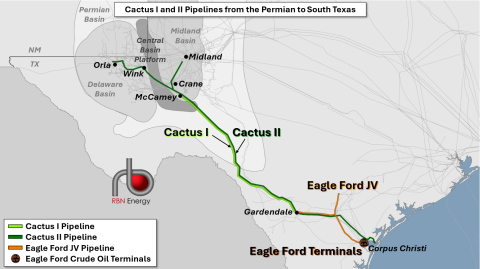

Now for the physical details. Construction of Cactus I began in early 2014 to handle surging Permian output and provide a direct link from the Midland Basin, originating at McCamey in West Texas and connecting to Gardendale in South Texas, a route that bridged the Permian and Eagle Ford basins for the first time. The 310‑mile, 20‑inch-diameter pipeline started in early 2015 with a capacity of 250 Mb/d, but rapid growth in Permian production quickly outpaced that. By late 2017, Plains added pumps and upgrades, boosting Cactus I’s capacity to 390 Mb/d, where it stands today.

Our focus in today’s blog is crude delivered from the Permian to Corpus Christi, but Cactus I terminates in Gardendale, not in Corpus Christi. But think of it as the first runner in a relay race, carrying the baton of crude oil to Gardendale. From there, the Eagle Ford Pipeline (orange line in Figure 2 below), which is owned 50/50 by Plains, the operator, and Enterprise Products Partners, takes over, carrying the crude the rest of the way to Corpus Christi where the JV has connectivity to Ingleside and an export dock — Eagle Ford Terminals (black barrel icon).

Figure 2. Cactus I and II Pipelines from the Permian to South Texas. Source: RBN

Cactus II was developed to alleviate more Permian pipeline bottlenecks caused by surging production. The pipeline’s construction was led by Plains with the JV mentioned above (Western Midstream, Enbridge, etc.). Ground was broken in late 2017 and the project was completed on a fast-paced schedule. The 26-inch pipe runs 575 miles, mostly paralleling Cactus I, but it starts farther upstream, with legs that reach into the heart of the Midland and Delaware basins. Cactus II entered service in August 2019, initially at 585 Mb/d, but it was soon expanded to 670 Mb/d as more anchor shippers signed long-term contracts.

Cactus II originates at Plains’ Station 285 near Orla and also connects to the Plains Wink South terminal and to McCamey. Cactus II’s tariff also has origin points at Midland and Crane; service is provided through “displacement,” which allows the Plains regional network to re-route barrels to the pipeline, since Cactus II doesn’t physically touch Midland or Crane. Cactus II delivers crude to three major locations in South Texas: George West, Taft and Ingleside. George West in Live Oak County is a connection point for crude toward coastal markets and lines up with other pipeline systems, setting up transfers to ships. Taft, just west of Ingleside, is a terminal that supports regional refinery intake and offers access to export infrastructure. Ingleside, located across Corpus Christi Bay from Corpus proper, is home to EIEC and STG.

Cactus II, along with EPIC and Gray Oak, have been critical to Corpus Christi’s development into a preferred crude oil export location in recent years, in part because of the ability of EIEC and STG to receive and partially load Very Large Crude Carriers (VLCCs). Cactus II is connected to EIEC and is expected to complete a connection to STG later this quarter.

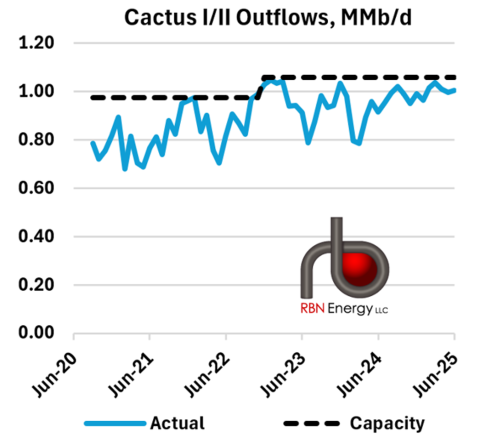

As shown by the blue line in Figure 3 below, combined flows on Cactus I and Cactus II have recently topped 1 MMb/d, up significantly from September 2023. From July 2024 to June 2025, the most recent month the Railroad Commission data is available, combined flows on the two pipes have maintained 90% utilization or higher (where the blue line is close to the dotted black capacity line). In fact, the first six months of 2025 averaged 95%.

Figure 3. Cactus I and Cactus II Crude Oil Outflows. Source: RBN Crude Oil Permian Report

The Cactus pipelines together account for more than one-third of the total Permian-to-Corpus capacity and flows, which total 2.64 MMb/d. As we said, the other major players are EPIC Crude and Gray Oak, both of which came online within months following Cactus II’s startup. Gray Oak is an 850-mile, 20-inch pipeline operated by Enbridge that runs from West Texas toward Corpus Christi and Ingleside. Earlier this year, Enbridge completed Phase 1 of a major expansion, adding 80 Mb/d to boost Gray Oak’s total capacity to 980 Mb/d. Phase 2 will bring an additional 40 Mb/d online in April 2026. EPIC Crude runs parallel to Gray Oak for much of the route. EPIC has been flowing above its 600-Mb/d original nameplate for more than a year, as we discussed in You’re Gonna Go Far. All four Corpus-bound pipelines combined (Cactus I, Cactus II, Gray Oak and EPIC) have been above 90% utilization most months since late 2022, as discussed in our weekly Crude Oil Permian report.

Before we get to rates and other details on the Cactus pipelines, we should note there’s a lot more to the Plains/Permian story than these two pipes. In addition to its Cactus I and II ownership, the company also owns and operates the Basin Pipeline from Wink to Cushing, OK, storage hub and controls major regional lines like the Mesa and Sunrise pipelines that connect Midland to Colorado City, TX. Plains also owns 40% of BridgeTex Pipeline, which moves crude from Colorado City to East Houston, and has an interest in Wink to Webster Pipeline LLC, a complicated JV for the 650-mile Wink to Webster pipeline that we detailed in My Way. (The JV has 1.05 MMb/d of capacity on the 1.5-MMb/d pipeline. The remaining 450 Mb/d is represented by Enterprise’s 29% undivided joint interest in the pipeline, represented by its Midland to ECHO 3 pipeline.)

Rate Changes

Rates on Cactus II are shifting — both up and down, depending on the customer type. A tariff increase for public rates on Cactus II was filed in July by Plains and Enbridge, changing rates for customers without negotiated contracts to around $2.50-$3.70/bbl for most origin-destination pairs, up from $2.46-$3.63/bbl in 2024. The public rates went up because of scheduled cost adjustments.

Another item of note is that rates for one of the anchor shippers on the pipeline dropped from $1.30/bbl to $0.90/bbl due to an initial contract term expiring and the shipper exercising extension options through 2029 at a previously negotiated rate. It’s possible the pipeline could see its annual revenue from Trafigura drop by as much as $43 million, according to published reports. However, this would be considered a “below-market” rate based on commentary from Plains discussing successfully re-contracting a number of its long-haul pipelines, including Cactus I, Cactus II and Sunrise.

In summary, the Plains-operated Cactus I and Cactus II pipelines have helped to make Corpus Christi/Ingleside a primary destination for Permian-sourced crude — only a handful of systems in the U.S. can transport as much oil. Even with the addition of the EPIC Crude and Gray Oak pipelines in 2019, the pipelines to the Corpus Christi area are running close to full. And the competition between these pipelines and the pipes to the Houston area is fierce.

Taylor Noland co-wrote this blog post.

“Can’t Hold Back” was written by Chris Gates, David Roach, Patrick Muzingo and Clay Anthony. It appears as the third song on side two of Junkyard’s eponymous debut album. The hard-rocking song about a Hollywood rock-and-roll girl is powered by loud guitars and the strong vocals of David Roach. Personnel on the record were: David Roach (lead vocals, percussion), Chris Gates (guitar), Brian Baker (guitar), Clay Anthony (bass) and Patrick Muzingo (drums, percussion).

The album, Junkyard, was recorded at Conway, Studio Sound, and One On One in Los Angeles during 1988 and 1989. Produced by Tom Werman, the album was released in May 1989 and went to #105 on the Billboard 200 Albums chart. Two singles were released from the LP.

Junkyard is an American rock band formed in East Hollywood in 1987 by Austin, TX, punk-rock musicians Chris Gates (Big Boys), David Roach (Strappados, Pagans) and Max Gottlieb (Strappados), along with Los Angeles musicians Johnny Hell and Clay Anthony. The band made a name for themselves in the Los Angeles underground club scene with a sound combining Motorhead with Lynyrd Skynyrd, with a healthy dose of punk-rock attitude thrown in the mix. Geffen Records signed the band in 1988. Drummer Hell was replaced by Patrick Muzingo (Decry) and guitarist Gottlieb was replaced by Brian Baker (Minor Threat, Dag Nasty). They released two studio albums and seven singles for Geffen. They have released four studio albums, a live album, an EP, and a single on indie labels. Ten members have passed through the band since its formation. Clay Anthony died in Hawaii in December 2020. David Roach died in Omaha, NE, in August 2025. The future of the band is unknown at this time.

On a personal note, David Roach has been a good friend of your managing director of musicology at RBN since the late 1980s. Junkyard, Little Caesar and my band, Dirty Dogs, shared a rehearsal studio in Hollywood back then. For a brief time, there was a magical scene of real rock-and-roll street bands playing the underground club circuit in Los Angeles. Real camaraderie and friendships were forged, all the cool bands would be at our friends’ shows, supporting them and nurturing the scene. David Roach was a guy who was a major part of that scene. He sang on some of my demos, we did a country project together, and he was always this great guy to know. He would always light up a room with his great personality, wicked sense of humor and rock-and-roll attitude. He was a great singer and performer, a chef, a family man, and will be greatly missed. Rest in peace, David. Sincere condolences to his family, friends, and Junkyard fans.