The U.S. Gulf Coast is poised to experience another big wave of new LNG export capacity, and this time it will be joined by new capacity coming online in both Mexico and Canada. The more than 13 Bcf/d of incremental natural gas demand from North American LNG projects starting up over the next five years will have significant effects on U.S. and Canadian gas producers, gas flows and (quite likely) gas prices, which have been deeply depressed for more than a year now. In today’s RBN blog, we provide updates on the 10 LNG export projects in very advanced stages of development in the U.S., Mexico and Canada, detail the expected ramp-up in LNG-related gas demand and discuss the potential impact of rising LNG exports on gas prices.

The Biden administration’s late-January announcement of a temporary pause in approving new LNG export licenses to non-Free Trade Agreement (non-FTA) countries — or extending existing licenses, barring special circumstances — grabbed headlines and raised energy-industry hackles. But while the pause has cast a shadow over several LNG export proposals nearing final investment decisions (FIDs), it has had little or no impact on the long list of projects with those Department of Energy (DOE) export licenses already in hand. In fact, as we said in How Do You Like Me Now?, the pause may well have a positive effect on a few U.S. and Mexican projects that already have non-FTA licenses — as well as Canadian projects that don’t need them — but had not yet received a final go-ahead from their developers.

(Two quick sidebars: First, a long list of major LNG-importing countries and regions fit into the non-FTA category, including the U.K., the European Union (EU), Japan, China, India, Brazil and Argentina. Second, a federal court judge in Louisiana on July 1 ordered that the pause be “stayed in its entirety, effective immediately,” but it’s unclear what the practical effects of that ruling will be.]

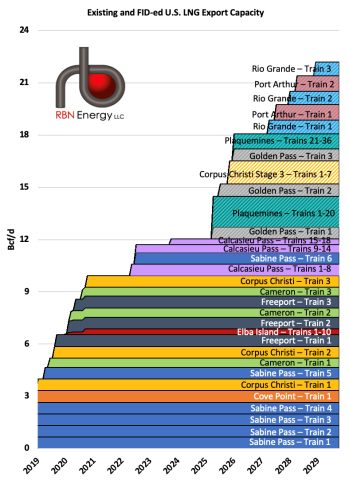

In any case, there is a long list of North American LNG projects — large, medium and small — that have reached FID and are either under construction or about to enter that phase. We’ll start with the U.S., which already has 12 Bcf/d of LNG export capacity in operation and is expected to add another 6.4 Bcf/d by early 2026 and an additional 3.9 Bcf/d in 2027-29 (see Figure 1 below). That would put U.S. LNG export capacity at more than 22 Bcf/d by the end of this decade.

Figure 1. Existing and FID-ed U.S. LNG Export Capacity. Source: RBN’s LNG Voyager

Join Backstage Pass to Read Full Article