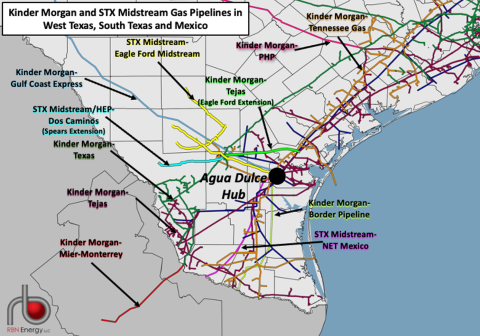

Kinder Morgan owns and operates natural gas pipelines across pretty much every part of the U.S., from California to Massachusetts and North Dakota to Florida. But if you look at a map of its gas pipeline assets, you’ll notice a focus on lines in the Lone Star State that serve as critical pathways for Permian- and Eagle Ford-sourced gas flowing to Mexico, Texas’s Gulf Coast and a number of existing and planned LNG export terminals. Now, Kinder is poised to significantly expand its pipeline network in that part of the world with the planned $1.8 billion acquisition of NextEra Energy Partners’ STX Midstream unit, as we discuss in today’s RBN blog.

Natural gas production is at or near record levels in both the Permian and the Eagle Ford. So are gas exports out of Texas to Mexico (via pipeline) and the rest of the world (via Corpus Christi LNG and several other liquefaction/export facilities up the coast). As we said recently in OMG, more gas pipeline capacity is being added between West Texas and the Gulf Coast with the 500-MMcf/d expansion of the Whistler Pipeline that came online in September and the 550-MMcf/d expansion of the Permian Highway Pipeline (PHP) that started up December 1. Beyond these projects, shippers will likely shift their attention to the startup of the new 2.5-Bcf/d Matterhorn Pipeline and a possible expansion of the Gulf Coast Express (GCX) system for additional Permian gas takeaway in the near term. All that will help feed gas to new LNG export capacity being planned in Corpus, Brownsville and up near Houston. And in Mexico, new gas pipelines are in the works, both to support additional gas-fired power generation and LNG exports south of the border.

Put simply, the natural gas sector in the Permian and Eagle Ford is firing on all cylinders, with production up, gas demand on the rise, gas processing and pipeline infrastructure heavily utilized and requiring expansion, and projects underway to do just that. However, as we said in our recent Let It Grow blog series, midstream companies have been allocating more and more of their cash flow to acquisitions, largely to expand their holdings in key basins like — you guessed it — the Permian and the Eagle Ford. A prime example of this midstream M&A is Kinder Morgan’s announcement last month that it has reached an agreement to purchase NextEra Energy Partners’ STX Midstream gas pipeline assets in South Texas and northeastern Mexico for just over $1.8 billion.

Before we get to the assets Kinder Morgan will be buying — the deal requires clearance under the Hart-Scott-Rodino Antitrust Act (which requires companies to file pre-merger notifications with the Federal Trade Commission and the Antitrust Division of the Justice Department for certain acquisitions) and is expected to close in Q1 2024 — let’s do a quick review of what Kinder already owns in the area.

Figure 1. Kinder Morgan and STX Midstream Gas Pipelines in West Texas, South Texas and Mexico. Source: RBN

Join Backstage Pass to Read Full Article